🏗 Procore - Building Collaboration in Construction

Overlooked #117

Hi, it’s Alexandre from Eurazeo. I’m investing in seed & series A consumer and consumer enablers startups all over Europe. Overlooked is a weekly newsletter about venture capital and underrated consumer trends. Today, I’m sharing a deep-dive on Procore which is a US-based and publicly listed vertical SaaS in the construction industry.

In previous editions, I mentioned that we’re intensively digging into vertical solutions (SaaS, marketplaces & fintech) for local businesses. We explained why building a vertical SaaS is an exciting opportunity and what the main levers to expand your total addressable market as a vertical SaaS are. We also published a first deep dive on an iconic vertical SaaS with Toast which is serving the restaurant industry.

Today, we’re sharing a deep-dive on another vertical SaaS behemoth called Procore.

It’s a vertical SaaS in the construction industry favouring the collaboration on mid and large construction projects between stakeholders like owners, general contractors, specialty contractors, etc. In 2021, Procore generated $515m in revenues (29% YoY growth) with 12k customers (30 of them generating more than $1m in ARR and 1.1k generating more than $100k ARR) and a 95% gross revenue retention rate. It has 2.9k employees and a $6.9bn market capitalisation.

I divided the paper into 2 sections:

Part I - What is Procore?

Part II - Why is Procore a Noteworthy Business?

If you’re building a vertical solution in the construction sector, I’d love to chat. You can send me an email at adewez@eurazeo.com.

Part I - What is Procore?

On a construction project, there are many stakeholders who can potentially use the Procore's platform:

Owners: They start construction projects. They work with architects and engineers to design the project. They hire a general contractor to operationally build the project.

General contractors. They work for owners. They lead construction projects. They hire and coordinate specialty contractors.

Specialty contractors: They are hired by general contractors for their specific skills (electrical, plumbing, roofing, etc.).

Architects and engineers: they work with owners and general contractors to design the project.

Financiers: they fund the project - either on equity or debt (released progressively when milestones are hit).

Insurers: they insure the project against unforeseen events (e.g. injuries, defects, natural disasters).

Materials and equipment suppliers: they supply materials and equipment to complete the project.

Procore is a vertical SaaS for the construction industry mid-market and enterprise construction companies.

It has 2 main values: it enables collaboration between stakeholders and it’s an end-to-end & open platform. Procore removes all the communication and data silos between stakeholders and within the tool-stack of each stakeholders.

Procore divides its platform into 4 product categories:

Pre-construction: it digitises the procurement process, selects specialty contractors and other vendors to realise the project.

Project Management: it streamlines the communication between stakeholders during the realisation of the construction project. It becomes easier to follow the project's progress and to make sure that procedures (e.g. safety or guidelines from the general contractor) are respected by stakeholders.

Resource Management: it tracks field workers’ productivity to improve time management and reduce reduce delay risk.

Financial Management: it helps stakeholders who work on several projects to have visibility on the financial health of all their projects and of their whole portfolio populated with data pushed from the field.

Within these 4 product categories, there are a couple of products that are worth mentioning:

Project Management: it provides accurate and real time data to all participants in a construction project. It's key to collaborate on core work-streams like schedules, specifications, submittals, drawings, RFIs and work-in-progress tasks. Moreover, it's used to collect information from the field and smoothly solve issues when they arise.

Safety: it's an app for field teams to record procedures in order to be in line with regulations and with quality specifications.

Building Information Model (BIM): users can view and collaborate on 3D models in the office or in the field to increase the productivity of the construction process.

Project Financials: it gives the construction project’s financial health with data updated from the field. It also a Trojan horse for Procore to start selling financial services to its customers (e.g. managing payments between stakeholders, doing project financing or selling a construction insurance).

Analytics: it's a verticalised business intelligence tool for the construction industry leveraging all the data collected by Procore and by the Procore ecosystem.

Procore is an open product with a rich ecosystem of 180 integrations on its marketplace. 70%+ customers use at least 1 integration and 40%+ customers use at least 2 integrations. Procore is connected with tools in areas like analytics, accounting, scheduling, compliance and CRM. With this ecosystem, data easily circulates within the tool-stack of customers and customers are not locked the platform when it has some limitations.

Part II - Why is Procore a Noteworthy Business?

1/ Construction is a large, under-digitized and underproductive industry.

Large: construction accounts for 13% of the global GDP and 7% of the global workforce.

Under-digitized: according to McKinsey Industry Digitalization Index, there is only the agriculture sector that is less digitized than the construction sector. Moreover, construction spends only 1.5% of its revenues in IT compared to 3% across industries.

Unproductive: in the past 2 decades, productivity in the construction increased by 1% annually compared to a 3% average across sectors.

2/ Procore builds the system of record not only for construction stakeholders but also for the whole construction industry.

Most vertical SaaS aspire to become the system of record for their customers but they rarely targets several stakeholders in the same industry.

On the contrary, Procore aims to become the ledger of the construction industry. It builds a platform that should be the digital cornerstone in all construction projects used by all the stakeholders in the industry (owners, general contractors, specialty contractors, workers in the field, etc.).

3/ Procore has a differentiated pricing strategy in the construction industry that creates a virtuous growth flywheel.

To spread Procore’s usage on construction projects, the company adopted adopted a pricing that is not per-seat but dependent on the number of Procore's products used and the annual forecasted construction volumes.

As a result, Procore's customers are incentivized to invite on the platform as many stakeholders involved on a construction project as possible. On average, a customer invites 170 collaborators on Procore and 60% of Procore's users are not (yet) customers.

It makes Procore's ROI more obvious because communication is smoother between stakeholders and it creates a pipeline of potential customers who're already familiar with the product.

4/ There are strong tailwinds for the rise of a solution like Procore in the construction industry.

The technology is mature to bring digitalization on the field with smartphone, mobile internet and IoT becoming commodities. It's key because 93% of workers on a construction project use a smartphone as companion for what they need to achieve.

There is a massive labor shortage in the industry that companies are trying to compensate with higher productivity. 83% of contractors have a hard time finding skilled workers.

It has become much more complex to comply with regulations. In North-America, the number of construction related regulations (e.g. related to workers safety or the environment) have increased from 463 in 1970 to 5.2k in 2017.

5/ Procore is a modular platform and does not sell a one-size fits all solution.

It's a platform with 16 products in 4 categories (preconstruction, project management, resource management and financial management) that can be sold separately. Procore starts by selling 1 product before upselling other products overtime to grow its AOV.

The 3 most used products are project management, quality & safety and projects financials. 59% of Procore's customers use more than 3 products and 41% use more than 4 products.

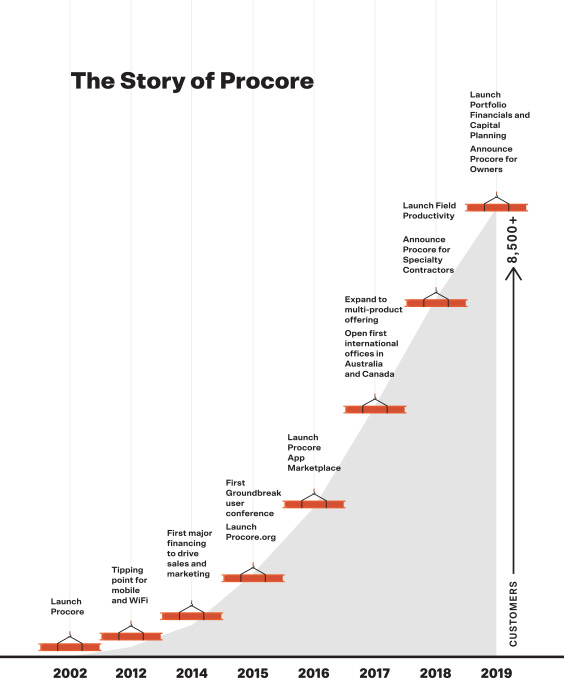

Procore started its platform strategy relatively recently. It had only 4 products in 2017. Since then, it has developed more products to become the one-stop-shop and to serve specific needs of certain stakeholders in the construction industry (e.g. the capital planning product built for owners).

6/ Procore is an open-platform with a rich ecosystem of 180+ integrations on its marketplace.

Procore removes silos between stakeholders in the construction industry but also between tools that can be used in the construction industry.

Procore launched an open API in 2015 and a marketplace of integrations in 2016. Procore's integration with accounting systems was key to accelerate the growth of the business.

Moreover, monitoring integrations is a great way for Procore to build its product roadmap or to build a pipeline of potential M&A targets - as integrations give you data on adjacent usages around your platform.

7/ Procore has developed the serial acquirer muscle with 5 acquisitions done in the last 4 years to expand its platform.

Most acquisitions have augmented Procore’s platform capabilities (e.g. analytics, BIM, estimates for pre-construction, project management for owners).

In Sep. 18, Procore acquired BIManywhere which was a Building Information Model (BIM) collaboration platform to provide access to all the stakeholders on a project to a 3D rendering of the construction work.

In Jul. 18, Procore acquired Honest Buildings which was a project management solution for owners and real estate developers. Procore leveraged the acquisition to start addressing a new customer persona in the construction industry which are the owners. Procore integrated the project management solution into its platform and made seamless the data flow on projects between owners and general contractors/subcontractors.

In Oct. 2020, Procore acquired Estico which was a solution in the pre-construction segment to streamline the estimation process done by general contractors for costs based on drawings, specifications and a built-in catalogue of materials.

In May 2021, Procore acquired Indus which was an AI-powered analytics platform for the construction industry. Indus was leveraging data from multiple sources (e.g. project management SaaS, cameras, sensors, drawings, BIMs) to make recommendations to construction stakeholders. Indus was on Procore's marketplace for over 3y before being acquired.

In Sep. 21, Procore acquired Levelset for $500m ($425m in cash, $75m in shares). It's a lien right management platform for the construction industry which is key to manage complex compliance workflow and improve the payment process in the construction industry.

In Oct. 21, Procore acquired LaborChart which is a workforce management solution for specialty contractors and general contractors. LaborChart has been on Procore's marketplace since Nov. 2020.

I'm convinced that being a successful serial acquirer can be a core moat and that it's a smart strategy to become one when you're a platform with multiple products addressing multiple customer personas.

Thanks to Julia for the feedback! 🦒 Thanks for reading! See you next week for another issue! 👋

I really liked this newsletter. Especially the Mckinsey chart and the way you used it to corroborate your point in the article