👩🏫 Learnings on Vertical SaaS from Toast & Procore

Overlooked #178

Hi, it’s Alexandre from Eurazeo. I’m investing in seed & series A European vertical solutions (vSol) which are industry specific solutions aiming to become industry OS and combining dynamics from SaaS, marketplaces and fintechs. Overlooked is a weekly newsletter about venture capital and vSol. Today, I’m sharing a follow-up post to the European vertical SaaS map that we co-published last week with Louis at Point Nine.

As a follow-up our European Vertical SaaS map, we also wanted to share a few recent observations exploring and investing in this ecosystem. As illustrations, we also show some recent slides coming from the financial reports of two publicly listed vertical SaaS companies in the US: Procore (PCOR) in the construction industry and Toast (TOST) in the restaurant industry.

1/ Public and private markets have realized that they can be great businesses.

The first learning is that public and private markets' perception of Vertical Software businesses has become more positive over the past few years. Not so long ago, we heard multiple times that i) these businesses were taking a very long time to build, and ii) the growth rates, often in the double-digit %age points <$50M in ARR (rather than triple-digit %age points), weren’t compatible with venture outcomes. Our learning is that the growth persistence of these businesses can be very high. Maintaining growth to good enough levels above $100M in ARR made them much more attractive to financing markets.

Procore paved the way, taking over 10 years to reach $10M in ARR but less than 10 to reach >$1Bn in ARR. The company is now at close to $10bn in public markets. In the P9 Family, Jobber and Clio kept growing consistently but saw significant valuation increases only in the past 2-3 years (ca. 10x valuation increase to unicorn or above-level valuations for both).

Long story short, it is now much clearer that, although they take a long time to build, vertical software businesses can become very valuable. However, it might be that the lion’s share of value creation happens more than 10 years after starting.

(It might be that in another 10 years, we’ll be able to make a similar graph to the one above but for Vertical Software businesses.)

2/ Penetration across markets is still low.

Reflecting on i) the long journey to $10M in ARR and ii) the consistent growth after, we learned two lessons.

On the one hand, the “why now,” i.e., what drives adoption, is often linked to a broad but often slow digitization of an industry that just takes a long time. Unlike developers who will adopt new technologies very fast (which explains dev tools' very fast growth rates), industry practitioners vertical by vertical will switch software less frequently, be harder to convince, but ultimately be “stickier.”

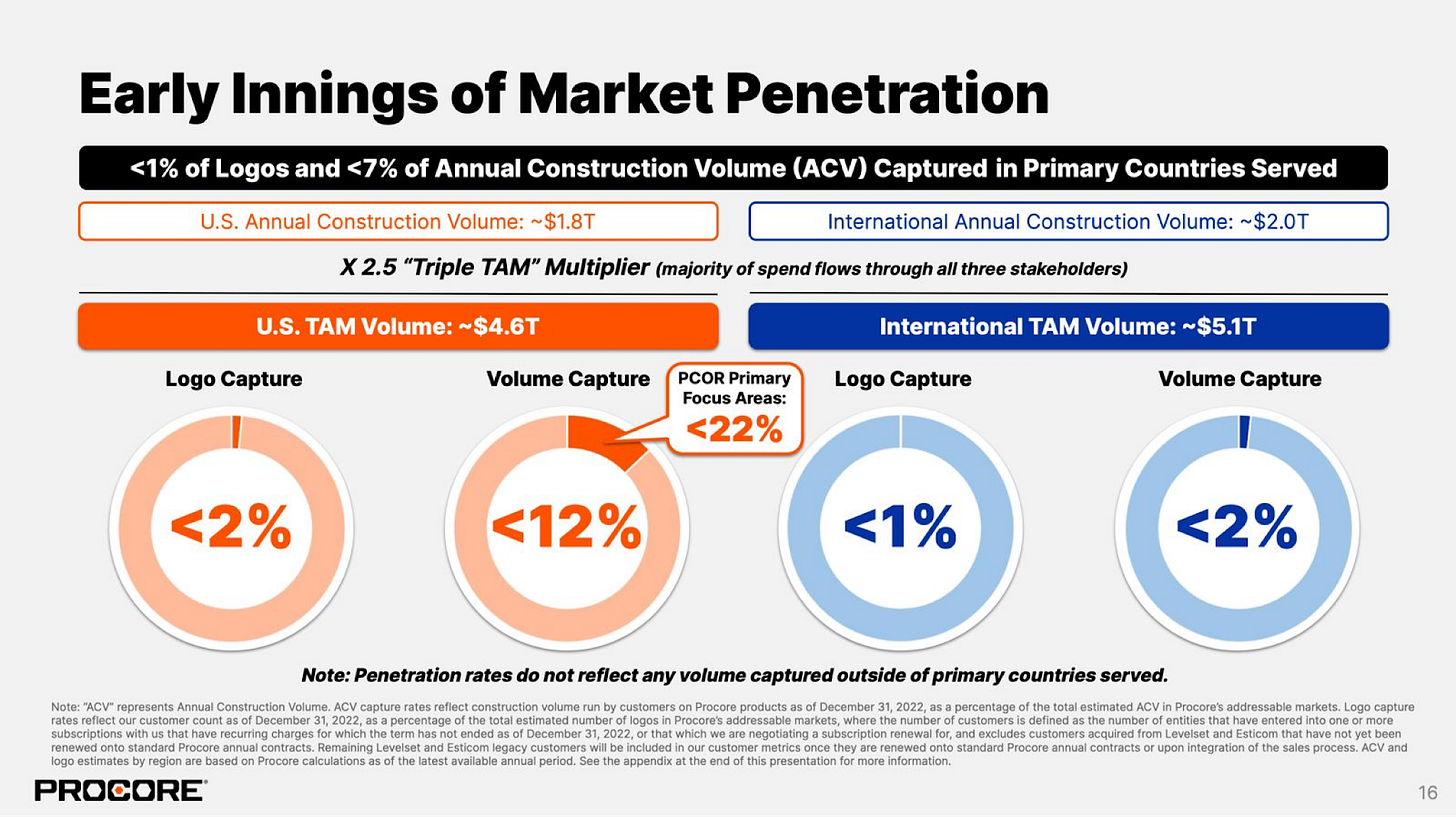

Despite being in business for >20 years and valued at >$10bn in public markets, Procore only has <2% of US construction companies and <1% globally. See the slide of their latest public report below.

Similarly, Toast only has a 13% market of all US restaurants and a 15% market share of payment volume despite having been founded more than a decade ago in 2012.

On the other hand, the product suites of these businesses kept growing, helping companies have more arguments to fight against a “slow why now”. Have a look at Procore’s and Toast’s very comprehensive product suite below.

3/ These are truly “compound companies” benefiting from economies of scale.

Another lesson learned from examining the comprehensiveness of these companies’ products is that Vertical Software businesses benefit from strong economies of scale.

On the ACV/LTV side, each new product feature helps companies increase ARPAs, provides additional arguments to convince customers, and ultimately allows companies to spend more on acquisition while maintaining good CAC/LTV ratios. Vertical Software companies are often good illustrations of the model that Rippling’s founder Parker Conrad calls “compound companies”.

On the acquisition side, once a company reaches a certain market share, word of mouth and referrals kick in, ultimately making vertical software businesses more efficient from a sales and marketing standpoint than their horizontal counterparts (look at ICONIQ’s report here for more).

Toast’s goal is to aim for a very high market share in a given geographical area (e.g. a city, a neighborhood), leveraging social proofs between restaurants in a community to generate referrals and decrease CACs at scale. During Toast’s latest investor day, Jonathan Vassil (Toast’s CRO) stated, "When you look at our top 10 most penetrated markets, you would expect these markets to show declining growth, but in fact, they are our fastest-growing markets.”

Toast Q1-2022’s investor presentation showing that the more market share you have in an area, the higher your inbound rate and the higher your growth rate

Last, the bigger the product suite, the less likely a competitor will ultimately enter this market.

4/ Multi-product expansion strategies i.e. Vertical Software 2.0

Speaking of expansion strategies, as explained in more detail in our “Vertical Software 2.0” blog post, product expansion strategies often go beyond building more workflow features. Vertical software businesses can expand by building fintech, B2B marketplace, Logistics tech, or ad tech value propositions on top of their software. Procore launched its payment features only in September 2023.

5/ The new Wedges to digitize an industry

Returning to the “slow why now” point, we’ve seen more vertical software businesses try to digitize a market without starting with a workflow software value proposition.

Wikifarmer is trying to digitize the farmer’s market by starting with a B2B marketplace value proposition that helps farmers sell with fewer intermediaries. They’re not selling farm management software at first, but they might eventually build more and more software features as the marketplace grows.

Intenseye is trying to build next-generation Health and Safety compliance software, starting with automated camera feed monitoring in manufacturing facilities (ie. an AI value proposition).

Zentist builds cash collection software to digitize the dental office's back office.

Ultimately, we believe that every company will likely fight to be in a defensible competitive position, which often means owning the industry's system of records.

6/ What’s the “Right to win” in a segment?

Reflecting on the key success factors of vertical software businesses, we keep wondering about the extent to which an initial value proposition gives a company the “right to win” in a market segment that is hopefully large enough.

Is the company more likely to go upmarket or expand the product suite? If they go upmarket, which competitors will they run into? How will the market ultimately be segmented?

Making it even more concrete, taking again the example of the construction industry:

to what extent does being the ERP of small construction businesses allow you to expand into fintech? Will a fintech-first player like a bank for construction companies grow faster and easily expand into workflow software?

Is it likely that being the ERP of small construction companies allows you to go upmarket?

Is winning large construction companies' “timing/schedule management software” a large enough market to build a $100M ARR business?

Will the US player win in Europe, or are there too many local specificities?

Analyzing and betting on some of the above requires some careful analysis of segment size, some creativity on natural expansion potential, and a good amount of faith 👍

We’re excited to continue being a little creative about how big vertical Software businesses can become. As said previously, we think it’s still very early days.

Thanks to Julia for the feedback! 🦒 Thanks for reading! See you next week for another issue! 👋