Hi, it’s Alexandre from Eurazeo. I’m investing in seed & series A consumer and consumer enablers startups all over Europe. Overlooked is a weekly newsletter about venture capital and underrated consumer trends. Today, I’m sharing a collaborative essay with Pietro from Stride.VC on angel investors in France.

This is a collaborative essay with someone I’ve been working with for a while: Pietro Invernizzi. Pietro is a Principal at Stride.VC, a boutique seed venture fund based in London and very active in France. He’s been a community builder and advocate for angel investors for c.6 years now, writing a lot of content about angel investing and hosting several events dedicated to bringing the angel ecosystem together. (Go follow him on Twitter and come back).

Who are 50 of the most active and engaged angel investors in France? What are the 10 most interesting things we’ve learned from them? What needs to be done for France to get to the next level?

In this paper, we answer these questions by digging deep into the French angel ecosystem. If you want to learn more about the French tech ecosystem, you should read Alex’s 2022 State of the French Tech Ecosystem.

We divided this post into 2 parts:

Our 10 key findings about the French angel ecosystem

The future of angel investing in France

Part I - Our 10 key findings about the French angel ecosystem

(1) The first generation of super-angels was crucial to create a vibrant tech ecosystem in France

Some super-angels have been feeding the ecosystem for over 10 years now: people / institutions like Kima, Zenly’s founders, Secret Fund, etc., followed by the Voodoo’s founders, Jellysmack founders etc. These first seeders gave money, know-how and expertise to an ecosystem at a time when no one was betting on pre-series A founders. By writing €25-250k checks on an almost weekly basis, they provided a lot of needed confidence to thousands of founders. As Connor Murphy tweeted, “investors who make the first / earliest commits, often without asking ‘who else has committed’, are the hidden stars of pre-seed/seed. They don’t always get mentioned in the final fundraising announcements, but they are the spark that gives the whole round momentum”. This is what these players did.

(2) Angel investing in France has some super-players that see most of the deals happening in the country

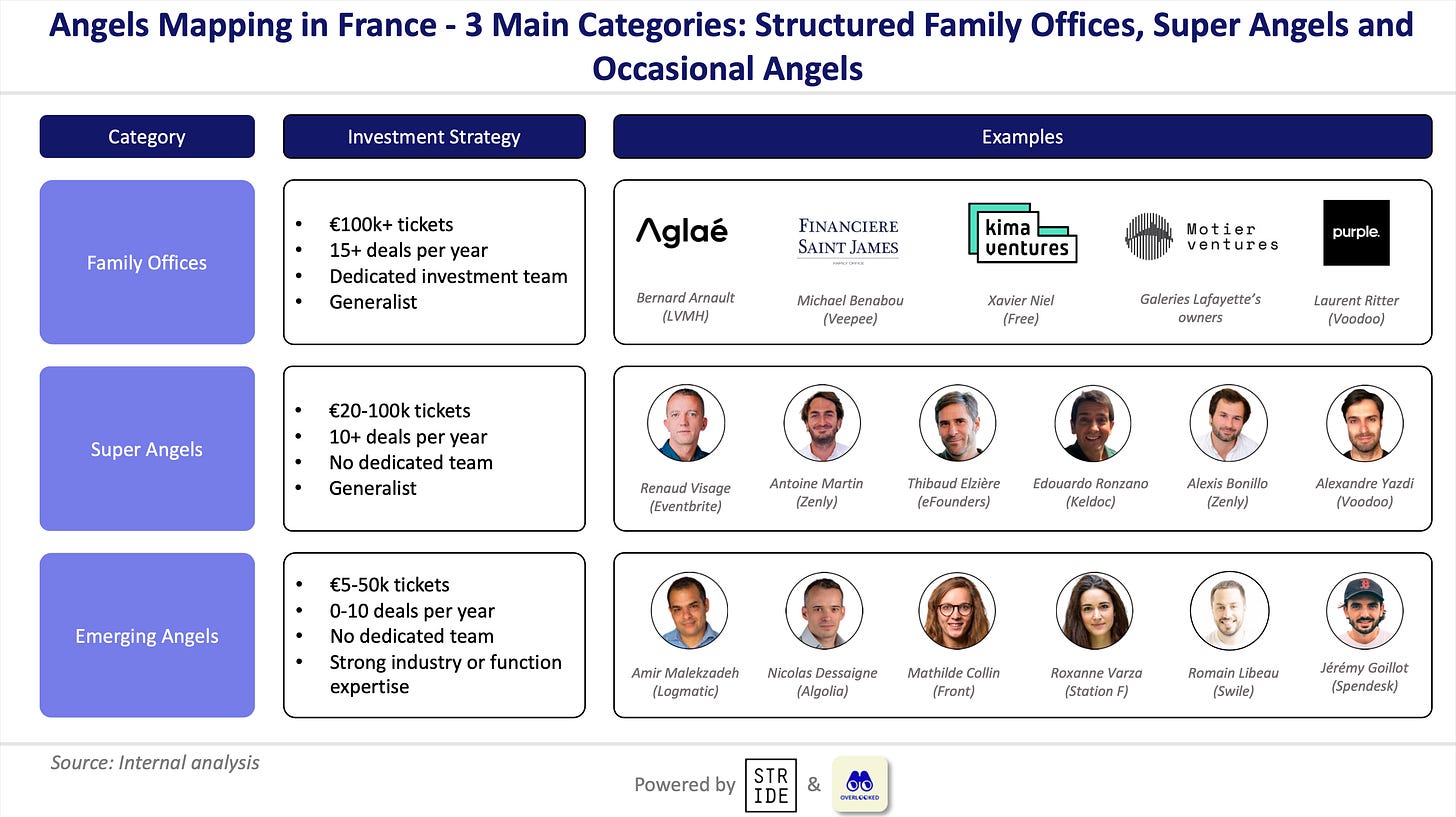

These players can be broken down into 3 main categories:

Structured family offices (e.g. Kima, Financière Saint James, Aglaé): angels who have professionalised their activity building a dedicated investment and portfolio support team. They are sector agnostic. They invest six-figures tickets at seed stage and can reinvest at later stages. They close 15+ deals per year.

Super angels (e.g. Thibaud Elzière, Antoine Martin): angels who are spending a significant portion of their time investing into startups developing playbooks to source, due diligence and support companies. They also are sector agnostic. They invest €20-100k tickets and most of the time they don’t reinvest. They do 10+ deals per year.

Emerging angels (e.g. Amir Malekzadeh, Jérémy Goillot): angels who have a unique superpower around an industry (e.g. Romain Libeau in fintech) or a function (e.g. Amir Malekzadeh in dev. tools or data). They tend to invest in companies for which they can leverage their expertise. They invest €5-50k tickets and they don’t normally reinvest. They do 0-5 deals every year.

(3) Angel investing in France has a high degree of sophistication

The level of depth of the ecosystem is impressive, exhibiting:

Very sophisticated family offices as we saw above (e.g. Kima, Financière Saint James, Aglaé)

Angels joining scout programs for top European and US funds, so that they have more capital to invest, either in more companies or more per company (e.g. Alexandre Berriche for Sequoia or Alexandre Prot for Hedosophia).

Micro-funds fully funded and operated by business angels. For instance, several angels gathered around Eduardo Ronzano to deploy an angel-only fund called Secret Fund, which invested €250k in 60+ French startups between 2018 and 2021. Another example is Leia Capital created in Dec. 2021 as an angel fund funded by women and investing exclusively into women-led startups.

Angel support groups: flexible structures where angels collaborate on sourcing, due diligence and founders support. For instance, we interviewed Renaud Visage and Amir Malekzadeh who are both part of the Whisperers, a group of operator angel investors. They gather on a regular basis to exchange deal-flow, brainstorm on deals and to discuss how they can better support the entrepreneurs in which they invest. Participating angels remain independent though and everyone makes their individual investment decisions.

Going forward, we wouldn’t be surprised if that professionalisation moved forward at an increasingly rapid pace, driven by the growing maturity of the ecosystem as well as the development of a financial / legal infrastructure stack that will facilitate investing into European companies. For instance, initiatives like Roundtable.eu & Vauban are working towards funds-as-a-service or syndicates-as-a-service like AngelList did in the US.

We could also see more angels becoming solo-GPs (e.g. Elad Gil in the US) or former entrepreneurs / operators investing as angels and deciding to join forces to build a fund (cf. the inception of Founders Fund or a16z in the US).

(4) The French angel ecosystem is a closed one and very hard to penetrate for outsiders

A lot of the big name angels that we’ve mentioned see every deal that comes out on the market. But if you’re not French, or have no ties with France whatsoever, it becomes very difficult to be presented deals, even if you have a very strong profile or are well known in other markets (e.g. Berlin / London). Quite a few of the key players have known each other for a long time and so entering the circle is difficult.

(5) Angels are not equally supporting founders

Most angels are passive investors and proactive angels are gems. The track record and the amount invested into a company is not correlated at all with the support angels will bring to you. A good practice is to ask other founders who are the 2-3 most useful angels they have on their cap table.

(6) The level of competition between angels to get allocation into competitive rounds is rapidly increasing

Angels are competing both with other angels and venture funds (which want to maximise ownership). As the ecosystem is now more mature, to win a seat at the table, angels need to have a top personal brand or to have a unique edge to support the company that is raising (e.g. functional or sector expertise).

(7) Many Parisian angels are now scouts for top European and U.S. funds

In Paris, 15+ entrepreneurs or operators are working as scouts for a top U.S. (e.g. Sequoia, General Atlantic, a16z) or European (Accel, Blossom, Northzone) funds. It’s funny to now see scouts from 3-5 different funds investing into the same company. It proves that foreign funds now find the French ecosystem attractive enough to monitor and understand that scout programs are a good technique to break into an ecosystem known for being hard to penetrate.

(8) During the bull market, everyone wanted to be an angel investor. It’s no longer the case in a bear market.

In 2020-2021, everyone wanted to invest into startups. Startup employees started to invest into companies started by their friends. Retail platforms to buy startup shares like Crowdcube or Caption experienced a strong traction. As a result, many people invested without the knowledge needed and over-indexed their investment allocation into private startups. With the public-stock market crumbling down and with a looming recession, these people will stop investing in tech and experienced angel investors will also slowdown their investment pace.

(9) France has strong tax incentives for angels

France offers tax incentives to angels including: (i) a 18-25% of the amount invested as tax rebate via a mechanism incentivising French people to invest into SMBs, (ii) lower taxes or no tax on capital gains at exit if the investment was done via a special investment account, (iii) tax reports when your redeploy your capital gains post exit as an entrepreneur.

(10) To bring the angel investing scene to the next level, we need more education, more diversity & more experienced operators

While interviewing angels in the ecosystem, we noticed several recurring topics to bring the angel investing scene to the next level:

Education to reduce the barrier to entry to start investing as an angel.

Diversity. There is not enough diversity amongst angel investors. It’s a recurring topic that we also see amongst institutional investors and founders in France. As Anh-Tho says below: “There's a huge lack of diversity, I've invested in 15+ deals and I'm most of the time the only woman on the cap table, let alone the only woman based in France.”

More experienced operators becoming angels. As the French ecosystem is still maturing, there is still an experience gap amongst startups to scale companies from series B to IPOs. As Renaud Visage says below: “We desperately need more experienced operators to start angel investing to bring the French scene to the next level. We have incredible engineers in France but, in my experience, it’s still very hard to find experienced operator angels who have long track records in enterprise sales, marketing, customer experience management, and product development. It’s changing as more unicorns emerge out of France but we’re a long way from other tech ecosystems in that regard.”

Part II - The future of angel investing in France

This section is our contribution to bring angel investing in France to the next level. We selected 50 angels in France with 3 criteria: (i) they’re not necessarily the usual suspects you can think of when you’re talking about French angels, (ii) they all have a super power to support founders - usually a matter of function or industry expertise, (iii) they have already invested as angels into various exciting startups. This list is highly subjective, and we know that we may have missed great angels. If you have any great recommendations, please do send us an email (pietro@stride.vc, adewez@eurazeo.com) as we plan to update the list on a regular basis.

Amirhossein Malekzadeh (Logmatic, Datadog | #Dev. Tools, #Data, #Cyber)

Background: Amir started his career in consulting before becoming an entrepreneur in 2012. In 2014, he founded a log analytics platform called Logmatic that he sold to Datadog. Amir stayed at Datadog for 4 years integrating its log product into Datadog’s platform and working in corporate development.

Investment themes: B2B SaaS (dev. tools, data tools, cybersecurity), climate

Track-record: 40 investments including Airbyte and ProcessOut

Investments in 2022: Kestra, DinMo, Gladia, Ondorse, Popsink, Fabriq

Super-power to support entrepreneurs: being a bouncing ball for entrepreneurs when they want to brainstorm or have an outsider look on a topic.

Eduardo Ronzano (KelDoc | #Fintech, #Fundraising)

Background: Eduardo started in the tech industry in 2010 by working as a fundraiser with Pascal Mercier. He left in 2012 to build KelDoc.com, a digital marketplace that connects healthcare professionals and patients. He sold the company to NEHS Group in 2015. He became a full-time business angel when he left NEHS in 2016 and has invested in 120+ companies and has 12 exits to date.

Investment themes: generalist with a current preference for fintech, infrastructure and web3 topics

Track-record: Spendesk, Paack, Lifen, Cowboy, Yubo, Stonly, Planity, MemoBank, Stockly, Jitter, Livestorm, Meero, Kiln, Bricks

Investments in 2022: Morpho Labs, Merge, Dawn Global, Rayon, Evy

Super-power to support entrepreneurs: the first person entrepreneurs call when they are facing difficulties. Guide entrepreneurs through 2 key processes: hiring the best talents and raising with top VCs.

Alexandre Berriche (Fleet | #Capital Efficiency)

Background: Alexandre started his career in the tech industry at Rocket Internet in North Africa. He left to become VP Ops and Expansion at edtech Ironhack. After this experience, Alexandre confounded a bootstrapped startup called Fleet which is an IT leasing solution. In parallel, he started to invest in startups. He became Sequoia’s scout in April 2021.

Investment themes: generalist

Track-record: Stoik, Claap, OnePilot, Join, Formance

Investments in 2022: Windmill, Wildsense, Payflows, Boku, DinMo, Numias, Numary, Immortal Games, Gladia, Jitter

Super-power to support entrepreneurs: using his experience as a bootstrapped entrepreneur to give tips on how to be frugal in the early days of a startup

Anh-Tho Chuong Degroote (Qonto, Lago | #Fintech, #Dev. Tools)

Background: Anh-Tho she started her career at McKinsey before joining Qonto as its 1st employee and building the growth team from pre-launch to the tens of millions of MRR. She is now co-founder at Lago which is a YC-backed company building an open-Source metering and usage based billing solution.

Investment themes: B2B fintech, infrastructure, dev. tools

Investments in 2022: Finfrog, Windmill, Easop

Track-record: Hugging Face, Djamo (Western Africa), Karbon (India)

Super-power to support entrepreneurs: A mix of:

Background and insights on marketing, growth and fintech

Hiring as I’ve done a lot of recruiting previously (sourcing, evaluations, defining and assessing business/tech cases, and closing)

Empathy: I try to be the angel investor I would love to have as a founder. Being a founder helps me better support other founders.

What is missing in France to bring the ecosystem / angel scene to the next level? We need more “education” on how to become an angel. As the French ecosystem is still young, we’re missing a middle class of angels besides scouts and super-angels. I also think there's a huge lack of diversity. I've invested in 15+ deals and most of the time, I’m the only woman on the cap table.

How do you think about productizing angel investing? How do you collaborate with other angels? There's a lot of excitement around this space at the moment. I think the last mile will always need to be 'hand made' (I can use tools to source, but it's only because of how the founder will feel when talking to me that I'll get in)... so generalist productivity tools cut the chase. My collaboration is very organic so far, as my main focus is growing Lago, not angel investing. As I'm investing in the fields I have expertise in - and where my company evolves - deal sourcing and investments come from people I know personally or already invested with.

What would you tell someone starting to angel invest today, based on your experience? Every time you invest, consider that you've lost your money. This the only way to go:

For your own sanity: it's a very risky investment, so if you can't lose the money, don't angel invest, resist the urge, even if it looks cool

For the founder's sanity: the last thing they want is the pressure of an angel that starts being controlling or anxious or remorseful about their investment.

Simon Dawlat (Batch | #Resilience)

Background: I’m primarily self-taught. I grew up online, founded my first company at the age of 17 which got me hooked with building software products and communities. Later, I studied modern literature and marketing then spent a few transformative years in Silicon Valley around 2007-08. Came back to Europe, started AppGratis which reached 50M users globally, went on to dominate the App Store’s rankings and was subsequently banned by Apple in 2013. Then Batch. I started angel investing in the process and wrote my first check in 2011.

Investment themes: generalist (except ad-tech businesses)

Investments in 2022: 24 investments including Jitter, Ulysse, Voggt, Numias, Alvo, Campsider, DinMo, Folk, Reflect

Track-record: Bankin (sold to BPCE/Natixis), Wit.ai (sold to Facebook), Glose (sold to Medium), Betterway (sold to Edenred)

Super-power to support entrepreneurs: I know mobile and SaaS OK. I’m decently good at connecting with people which subsequently makes me decent at selling, fundraising and hiring. I like to help with sales, leadership and culture but my true silver bullet into competitive cap tables is the consistent appeal of the AppGratis bedtime story of having had a billion dollar business taken away from me overnight and the resilience of recovering from that.

What is missing in France to bring the ecosystem to the next level? In terms of starting and getting off the ground I believe we have everything we need. The one thing that’s always missing when you’re growing quickly, say past the 100-ish people mark, is competent executives that have done it before at scale (emphasis on ‘at scale’). Now we should be at a moment in time where an entire generation of those execs have completed a first 5-7 years cycle and are coming out of the so-called « french unicorns », ready to move onto their next adventure. But the last couple years have been exhausting for so many that I fear a lot will want to go raise sheep on a farm in the south of France instead of rolling the dice a second time. Especially if they’ve made secondary money before the crash. I’m curious to see how this will play out.

How do you think about productizing angel investing? I’ve seen a wide array of initiatives around this idea but somehow it’s still mostly happening in small WhatsApp groups for me.

What was the best thing you’ve ever been taught in the startup world? Be like a duck. Remain calm on the surface and paddle like hell underneath.

Jérémy Goillot (Spendesk | #Growth, #Fintech)

Background: Jeremy was one of the first employee of the French Unicorn Spendesk (the Spend Management for SMBs leader in Europe). He spent the last 5 years building the growth department before launching the company in the US. Truly passionate about tech & startups, he started to invest as angel investor with his savings, before using the proceeds from his Spendesk stock-options to scale his angel strategy. He’s now focusing on investing in Africa with his side-fund and want to invest €50K in 15 companies next year.

Investment themes: SaaS, fintech, B2B

Investments in 2022: Defacto, Stoik, Reveal, Café, Folk

Track-record: Hightouch, Swan

Super-power to support entrepreneurs: I’m the best to find a way to acquire the first 1,000 customers. I’ll always find a clever acquisition strategy whatever the industry!

Why are you an angel investor? As a university drop-out, investing into startups is my personal MBA. I like to invest to learn more about adjacent topics to what I’m good at (growth, fintech and by being close to talented founders).

What would you tell someone starting to angel invest today, based on your experience? Don’t forget that you have 99% chance to lose your money. Yes, it’s fun, but it’s not easy to make money as an angel.

Hugo Amsellem (Jellysmack, The Family | #Consumer, #Creator Economy)

Background: I built a crowdfunding platform for artists a long time ago, then joined the founding team of The Family, a European startup accelerator that backed 700+ companies in 7 years. I followed the rabbit whole of the creator economy which led me to join Jellysmack where I'm now an advisor and working on M&A & strategy.

Investment themes: I genuinely love everything around content (gaming, audio, video, media/creator tech), community (consumer social, new forms of belonging), & commerce (e-commerce enablement, social commerce, etc).

Track-record: Spacefill, Unai, Creative Juice, Beehiiv, Clarisights, Flooz, Drop

Investments in 2022: Dmail, Club.fans, Futures Factory, Figures

Super-power to support entrepreneurs: I'm focused on a few topics I deeply understand and believe in. I'm building the best network of investors, founders & operators in the space and leverage it for intros, insights & hires.

How do you think about productizing angel investing? For me it's very simple: Content & Community. I practice what I preach. I publish content about the topics I'm covering (articles and soon a podcast) to expand my deaflow & network. I host invite-only consumer founders events all over Europe. Content & Community are the best leverage for investors, but they're best used on specific topics in my opinion.

What do you think about the angel investing scene in France? How has it evolved since you’ve started working in the space? What is missing in France to bring the ecosystem to the next level? It's night and day from when I was a founder in 2010. It used to be either 1) accountants or notaries who invested through tax-breaks and were a huge drag on cap tables or 2) a few individuals who got lucky during the 2000 bubble who told you how to run your business. We now have a full-stack angel investing scene with 1) top founders (Voodoo, Zenly, Hexa) who have professionalized their activity and are huge value adds to their portfolio, 2) top operators pooling their resources (Source Ventures) to back founders and 3) family offices (Motier, Kima) operating as super angels. In addition to that, the most drastic change is the mindset. France's pre-seed angel investment scene is a pay-it-forward positive-sum game where angels share their dealflow with one another, even if it means increased competition on some deals.

What was the best thing you’ve ever been taught in the startup world? One of the reasons I feel like I won't ever leave the startup world is the structural positive-sum game mindset of the industry. In tech, you have almost zero incentive to screw people over for a short-term gain. This is quite the opposite of the music business or entertainment world for example. Why? Because in tech, it's the magnitude of the outcome that counts, not the frequency of profit. So there's no point in acting like a parasite and taking from the right and left. This creates a natural & rational pay-it-forward culture that I have never seen anywhere else.

Renaud Visage (Eventbrite, #Climate)

Background: I’m the technical co-founder and ex-CTO of San Francisco-based Eventbrite (NYSE: EB), the global leader in event management. We raised $350M in venture capital over the years from Sequoia, Tiger and others and took the company public in 2018. I’ve been an operator angel investor since 2014 when I made my first investment (in Algolia, which became a unicorn eventually), and a venture partner with Index Ventures and now with Point Nine Capital. I try to share my personal experience with founders to help them realize their global ambitions. I co-invest sometimes with a few experienced angel investor friends as part of the Whisperers group which I co-founded and that is very particularly active in France. I’m also on the board of five startups including late stage scale-ups like ABTasty and Meister Labs. I left Eventbrite at the end of last year to focus on better understanding the biggest challenge we face as a species, climate change, and see how to best refocus my investments on climate tech.

Investment themes: I recently decided to focus all my angel investments in climate tech, and I’m thinking of launching a specialized fund in 2023 to help climate founders scale up.

Track-record: Algolia, Builder.ai, GitGuardian, Meero, Pigment (Series B, $163M raised), Scalefast, Sqreen

Investments in 2022: Agroleague, Aive, Dattak, Futurz, Greenly, Jitter

Super-power to support entrepreneurs: There are surprisingly very few unicorn CTOs who angel invest in Europe so it’s been pretty easy to get into deals as an angel investor. I have very good relationships with partners at many venture funds which helps me tremendously to get into more deals and helps my startups when they need to raise. My superpower I think is my ability to spot gaps. Gaps in strategy, gaps in storytelling, gaps in product functionality, gaps in organizational structures, etc. I somehow sense where there is something missing or where things don’t add up, and I’m able to help founders fill these gaps

What do you think is missing in France to bring the angel scene to the next level? We desperately need more experienced operators to start angel investing to bring the French scene to the next level. We have incredible engineers in France but, in my experience, it’s still very hard to find experienced operator angels who have long track records in enterprise sales, marketing, customer experience management, and product development. It’s changing as more unicorns emerge out of France but we’re a long way from other tech ecosystems in that regard.

What was the best thing you’ve ever been taught in the startup world? My co-founder, Kevin Hartz, always emphasized “the power of defaults” when we were launching Eventbrite and I’ve come to realize how important that is in the success of startups. Why complexify a UI when you can remove friction by picking the most logical defaults? This is a key principle for a smooth user experience.

Quentin Nickmans (eFounders | #B2B SaaS)

Background: Quentin is an entrepreneur based out of Brussels and Paris. He cofounded Hexa (ex. eFounders) a startup studio that has been building ventures like Aircall.io, Front.com and Spendesk.com for the last decade. Quentin is leading the finance and go-to-market topics for new projects and represent Hexa on several boards to help the companies along their path of growth.

Investment themes: Strong bias towards things I understand so SaaS (future of work). I like founders who’re focussed on product details and embrace high velocity.

Track-record: Notion, Payfit

Investments in 2022: Meterly, Rayon, Futurz, Figures, Job Protocol

Super-power to support entrepreneurs: I’ve a strong network in France and Belgium around everything fintech and SaaS. I can advise founders on how to prioritize in the journey to product market fit and on how to scale.

What do you think about the angel investing scene in France / Belgium? How has it evolved since you’ve started investing as an angel? There are an increasing number of people investing over the last decade. This is great. Operator investors are increasingly present. With initiatives like Roundtable.eu, they can join forces with people that are less networked but willing to invest as angels as well.

How do you collaborate with other angels? It depends where the opportunity comes from. If I receive an investment from my close network also investing in the deal, I often join the round without a strong due diligence. When it’s a more proprietary opportunity, I like to share it with the people in my close network with the most relevant experience to have their opinion.

What's the one biggest thing you've learned during your time building eFounders? Dream big and live towards it. With a positive mindset, everything is reachable

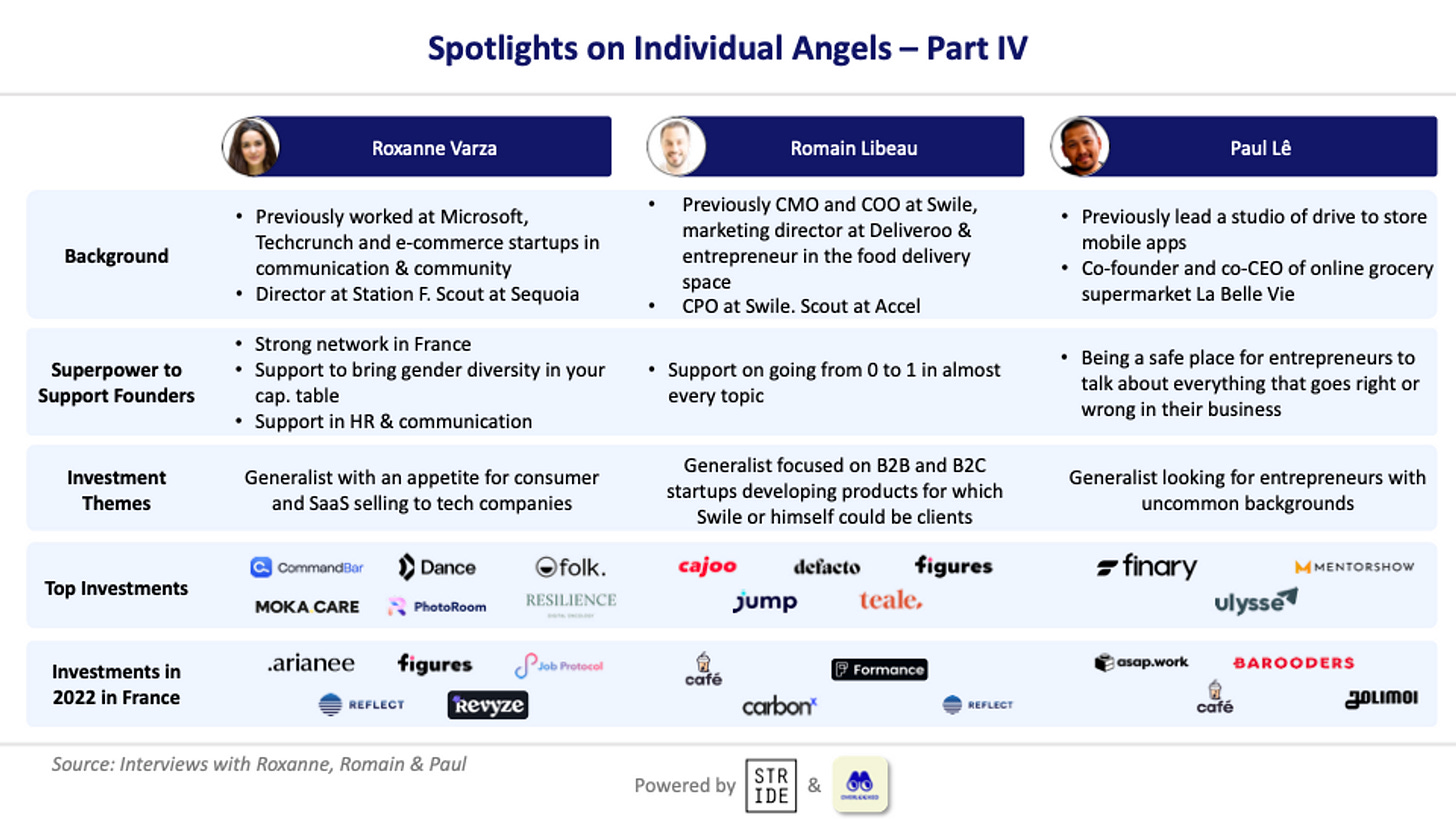

Roxanne Varza (Station F, #Diversity, #HR, #Communication)

Background: Roxanne has been leading Station F for 7 years. She started to invest as an angel via Atomico’s scout program before becoming scout for Sequoia.

Track-record: Resilience, Moka, Photoroom, Folk, Figures, CommandBar, Dance

Investments in 2022: Job Protocol, Revyze, Arianee, Relfect, Figures

Investment themes: generalist but I like B2B SaaS selling to tech companies and consumer

Super-power to support entrepreneurs:

Support to bring gender diversity in your cap. table

Support in HR & communication

Paul Le (La Belle Vie, #Consumer, #Coaching)

Background: Paul cofounded as CEO La Belle Vie in 2015 which is an online grocery supermarket. Previously, he was building drive to store mobile apps.

Track-record: Ulysse, Finary, Mentorshow, Legal Place

Investments in 2022: Asap, Café, Barooders, Jolimoi

Investment themes: generalist looking for entrepreneurs with uncommon background

Super-power to support entrepreneurs: creating a safe place for entrepreneurs to discuss every topic that goes wrong or right in their business

Romain Libeau (Swile | #0 to 1)

Background: Romain is currently CPO at Swile. He joined the company 6 years ago to build teams and function from 0 to 1 before recruiting experienced C-Levels. Previously, he was marketing director at Deliveroo and was entrepreneur in the food delivery space.

Track-record: Cajoo, Defacto, Figures, Jump, Teale

Investments in 2022: Café, CarbonX, Formance, Reflect, Hestia, Orus

Investment themes: generalist but I like products that I can relate to as a B2B or B2C customer

Super-power to support entrepreneurs: supporting entrepreneurs to go from 0 to 1 on almost every topic (e.g. GTM, M&A, building a team)

Other Angels:

Thibaud Elzière (Hexa, Fotolia | #SaaS)

Antoine Martin (Zenly | #Consumer)

Alexis Bonillo (Zenly | #Consumer)

Alexandre Yazdi (Vodoo | #Consumer)

Cédric Sellin (YogiPlay | #GTM)

Oleg Tscheltzoff (Fotolia | #Fundraising)

Nicolas Steegmann (Stupeflix | #AI)

Thierry Vandewalle (Wcube, ISAI | #Consumer)

Olivier Godement (Stripe | #Fintech, #Product)

Pierre-Antoine Dusoulier (SaxoBank, Ibanfirst | #Fintech)

Nicolas Julia (Sorare | #Crypto)

Julia Bijaoui (Frichti | #Consumer)

Mathilde Collin (Front | #Future of Work)

Bertrand Jalensperger (La Fourchette | #Impact)

Julien Lemoine (Algolia | Dev. Tools)

Deborah Rippol (Alan, Zéfir | Future of Work)

Marie Outtier (Aiden.ai | Climate)

Jonathan Widawski (Maze | #Design)

Matthieu Vaxelaire (Mention, Hexa | B2B SaaS)

Céline Lazorthes (Leetchi, Resilience | Impact)

Arthur Waller (Pricematch, Pennylane | #Fintech)

David Apple (Typeform, Notion | #PLG)

Guillaume Pousaz (Checkout | #Fintech)

Nicolas Brusson (BlaBlaCar | #Impact)

Louis Guthmann (Starkware | #Crypto)

Rachel Delacour (BIME, Sweep | #Climate)

Sarah McBride (Zenly | #Consumer)

Jean-Daniel Guyot (Captain Train, Memobank | #Product)

Nicolas Dessaigne (Algolia, YC | Dev. Tools)

Emmanuel Cassimatis (SAP | #Data, #Enterprise Sales)

Guillaume Princen (Stripe | #Fintech, #GTM)

Bertrand Diard (Talend | #Data)

Alexis Bonte (Storefront | #Gaming, #Crypto)

Romain Raffard (Bergamotte | #Consumer)

Guillaume Cabane (Segment, Drift, Gorgias | #Growth)

Stéphane Maarek (Conduktor | #Education, #Data)

Nicolas Douay (Keldoc | #Impact)

Dimitri Farber (Tiller, #GTM)

Vera Baker (Unconventional Ventures, #Sustainability, #Future of Work)

I’d like to thank everyone who contributed to the report both interviewees and sparring partners providing me with ideas and feedback. More specifically thanks to Pietro and Julia (🦒).

Dommage que vous n'ayez pas couvert FRANCE ANGELS, la fédération des Business Angels de France, ses 62 réseaux et les 40 -50M€ d'investissement annuels de ses membres dans les startups.

A votre disposition pour vous en parler

L article est intéressant mais il manque toutes les organisations de business angels qui grâce à l organisation et leur nombre important d adhérents représentent une part importante des investissements de business angels en france : elles permettent à des personnes moins expérimentées ou disposant de moins de temps de pouvoir investir dans des startups : je pense a BADGE (business angels des grandes écoles) et bcp d autres AMBA angels santé femme business angel’s..