👩🏫 PowerSchool - The All-in-One Platform for K-12 Education

Overlooked #171

Hi, it’s Alexandre from Eurazeo. I’m investing in seed & series A European vertical solutions (vSol) which are industry specific solutions aiming to become industry OS and combining dynamics from SaaS, marketplaces and fintechs. Overlooked is a weekly newsletter about venture capital and vSol. Today, I’m sharing a deep-dive on a publicly listed vertical SaaS operating in the education sector in North America called PowerSchool.

Today, I’m sharing another deep-dive on a publicly listed vertical SaaS called PowerSchool, which is building the all-in-one platform for the K-12 education sector in North America. I believe that it’s an interesting company because it operates in the education sector, which is an industry that I have not previously covered in this newsletter.

Moreover, contrary to most famous publicly listed vertical SaaS like Veeva or Toast, PowerSchool is an older company created in 1997 and has never been VC-backed. As a result, it has a financial profile that is closer to what we can see in buyouts, where the balance between growth and profitability is more steered towards profitability.

In 2023, PowerSchool reached $701m in ARR (17.7% YoY growth). The company went public in 2021. It has a $4.3bn market cap and a $4.7bn enterprise value, implying that the company is trading at a 6.7x EV/ARR multiple. PowerSchool has become the market leader in North America with 17k schools as customers in the US and in Canada, reaching 50m students (80% penetration in the market).

I divided this post into the following sections: (i) company history, (ii) product overview, (iii) financial and operating metrics, (iv) key learnings.

History

PowerSchool started as a simple school project. In 1983, as a high school student, Greg Porter developed a software for his school to track students’ attendance and send the information to the district.

In 1997, Greg founded PowerSchool, revisiting his high school project to transform it into a proper business. PowerSchool began with attendance tracking and was first implemented in Utah’s South Summit before evolving into a broader Student Information System (SIS). PowerSchool’s main innovation at the time was being web-based when schools were accustomed to on-premise software.

“To gain more clients, [Greg] also attended competitors’ presentations the day before he was scheduled to present, noted all the missing components of these systems, and added functions to his PowerSchool system that same night.” - Listedtech

In 2001, the company was acquired by Apple for $62m. In 2006, Apple sold the business to Pearson Education. In 2015, private equity fund Vista acquired PowerSchool for $350m. At this point, the company was generating $97m in sales and $20m in EBIT. After the acquisition, Vista kickstarted an intense build-up strategy. Since 2015, PowerSchool has acquired 18 companies to evolve from a Student Information System to an all-in-one platform for K-12 schools. In 2018, it notably acquired PeopleAdmin which enabled PowerSchool to add a robust HR product suite to its platform. During the same year, Onex invested alongside Vista in the business.

In Jun. 2021, PowerSchool went public raising $710m at a $3bn market capitalisation. In 2024, PowerSchool started to integrate more extensively AI into its platform with the release of its AI assistant called PowerBuddy.

Product

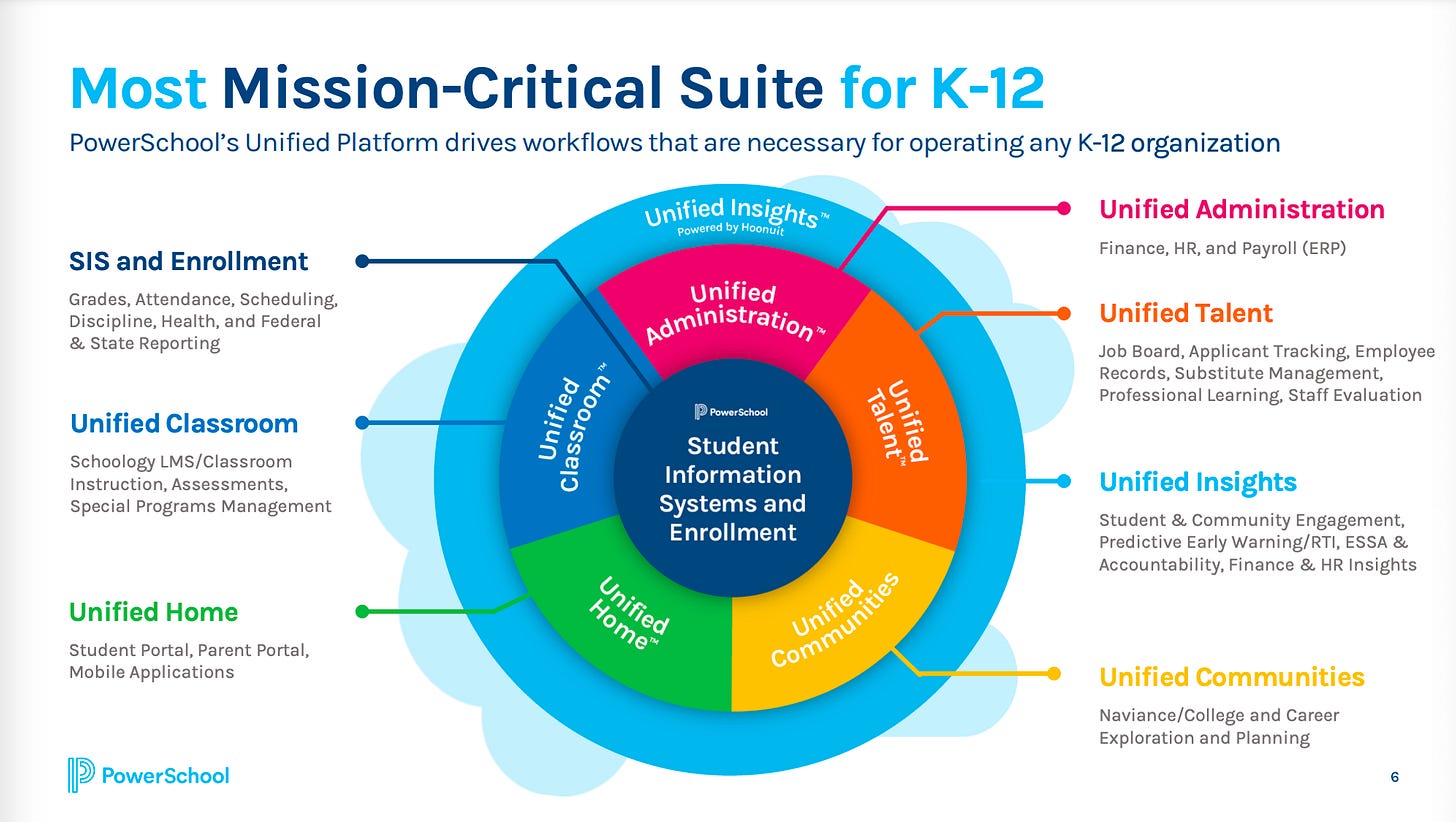

PowerSchool is an all-in-one platform for K-12 schools. It started as a Student Information System which tracks all the data associated with students. PowerSchool is a powerful platform because it’s used across all the stakeholders operating within a school ecosystem: school administrators, teachers, parents, students, and local public districts.

Student Information System (SIS), called Student Information Cloud: cloud based solution for student information, enrollment management, enrollment expenses, data management, document management, and special education. The SIS serves as the single source of truth for student data and is the backbone of K-12 organisations. Having up to date student data is essential for schools to comply with local and federal regulations and to obtain public funding which is the main revenue source for many schools.

Personalised Learning Cloud: enables teachers to create customised learning experience for every student with a curriculum builder, an assessment builder, a library of best in class education content and special education case management. PowerSchool leverages AI to go one step further in learning personalisation by recommending personalised learning paths and homework.

Educator Effectiveness Cloud: product to evaluate teachers and build them personalised learning paths to make sure that they grow into their role and that you can better retain them.

Student Success Cloud: product to support students so that they reach their full potential with the Multi Tiered Systems of Support (MTSS) framework to support struggling students, attendance tracking and behaviour support.

HR & ERP Cloud: product to streamline HR (job board, applicant tracking system, candidate assessment, employee records, substitutes management, payroll) and finance processes.

Data: data-as-a-service platform and business intelligence.

Communication tools for school to communicate with students and parents leveraging mobile apps and web portals.

On Jan. 24, PowerSchool launched PowerBuddy, an AI assistant designed for all stakeholders involved in K-12 education from schools to teachers, students and parents. It should be regarded as an AI layer that will be integrated into all products in PowerSchool’s platform. It will initially focus on use cases such as automatically generating lessons and assessments as well as extracting insights from the data collected in the Student Information System.

Operational & Financial Metrics

In 2023, PowerSchool achieved $701.5m in ARR (with a 17.7% YoY growth and a 13.6% CAGR over the past 5 years) and a 22.2% EBITDA margin. It means that:

In the US and Canada, PowerSchool operates at a significant scale being utilized by 90% of the top 100 districts in the US and by 80% of all the students in the US and Canada.

PowerSchool is a mature vertical SaaS which balance between growth and profitability leans more towards profitability than growth (similar to CCC in the auto and insurance industry). It adheres to the Rule of 40 with an EBITDA margin (22.2% YoY growth) making a greater contribution than ARR growth (17.7% YoY growth). It makes sense as it was a private-equity backed business owed by Vista and Onex before going public in 2021. It falls into a different category than vertical SaaS companies like Procore and Toast, which have an history of venture backing and continue to prioritise growth over profitability in the public market.

PowerSchool maintains a gross margin of 68.8% which falls below the average of publicly listed SaaS companies for two primary reasons. First, PowerSchool has not yet transitioned into a pure SaaS business model. While 70% of its revenues come from SaaS, it also generates revenue from software maintenance (16%) and license revenues (4%). This is because the company was founded in 1997 and has acquired multiple assets, including some that are not SaaS-based. PowerSchool relies on professional services to sell, operate, and upsell its platform. Professional services account for 10% of total revenues and carry a 23% gross margin.

PowerSchool has a low Net Dollar Retention (NDR) of 106.7%. For a business with AOV above $40k and which core growth strategy is to upsell new modules to the customer base I would have expected the NDR to be closer to 110-115%. This illustrates the challenge of selling to the public sector, characterized by highly complex sales cycles and a low willingness to pay. However, it’s important to nuance this point by acknowledging that the public sector is arguably one of the most loyal sectors. Although PowerSchool does not disclose its Gross Dollar Retention, it would not be surprising to see it above 95%.

PowerSchool has the potential to increase its revenues sixfold in the coming decade by upselling new modules to its existing customer base. While 80% of K-12 students in the US and Canada are exposed to at least one of PowerSchool’s products, a closer look at the product level reveals significant room for better penetration within schools. Currently, 70% of PowerSchool’s customers are utilizing only 1-2 products from its entire suite. Even its most mature product, the SIS, has only a 30% penetration rate, while the 14 younger products have an average penetration rate of only 10%.

Key Learnings From Studying PowerSchool

PowerSchool serves as an industry operating system for the education sector. It’s a platform utilised on a daily basis by all the stakeholders in the industry including school administrators, teachers, students, parents and, districts. In a previous newsletter, I highlighted this concept arguing that it’s a great position to be in as vertical Solutions because it enables them to “(i) significantly increase their addressable market, (ii) create defensibility through network effects and (iii) integrate additional business models into their platform.”

PowerSchool's initial product wedge was its Student Information System (SIS), designed to assist schools in complying with local and federal regulations. This serves as a crucial selling point for software to schools, as they require up-to-date and comprehensive student information to secure public funding. PowerSchool's SIS should be viewed as a revenue-generating product for schools, which is easier to sell than a cost-streamlining product.

PowerSchool is an answer to the education sector, which is craving an all-in-one platform. 74% of US districts are using more than 26 different tech solutions, which are point solutions not integrated with each other. PowerSchool offers an alternative paradigm with an all-in-one platform and an open model, allowing PowerSchool to connect to multiple point solutions to avoid data silos.

PowerSchool demonstrates that vertical Solutions can become market standards in their industry with market shares higher than what you typically see with horizontal software. PowerSchool has a dominant market position with 80% of US and Canada students and 90 of the top 100 US district exposed to its platform. Similarly to Doctolib in healthcare in France, this market dominance creates a risk of being accused of a monopolistic position by the government in a publicly funded sector.

PowerSchool's primary growth driver is cross-selling new modules to its existing customer base rather than expanding into new accounts. It's extremely challenging to penetrate schools initially, but once established, there's an opportunity to upsell new modules over time. PowerSchool utilises M&A both to enter new school accounts and to acquire new modules for upselling. Currently, 48% of customers have 2+ products, 17% have 4+ products, and 6% have 6+ products.

PowerSchool is a prime example of a publicly listed vertical SaaS company with a private-equity DNA. On the public market, you'll find two categories of vertical SaaS companies. On one hand, there are vertical SaaS companies with a VC DNA, prioritizing growth over profitability (e.g., Procore, Toast, Veeva), and primarily growing through organic means. On the other hand, there are vertical SaaS companies with a PE DNA, which are more profitable but experience slower top-line growth, primarily growing through external means (e.g., CCC, PowerSchool).

PowerSchool enables teachers to dedicate more time to teaching instead of administrative work. Currently, only 49% of a teacher's time is spent directly with students. Similar to doctors, teachers spend too much time on non-core tasks, leading to burnout. PowerSchool assists teachers in streamlining non-teaching responsibilities, allowing them to focus more on teaching. By integrating AI into its product suite, PowerSchool has the potential to further reduce the time teachers spend on administrative tasks.

Thanks to Julia for the feedback! 🦒 Thanks for reading! See you next week for another issue! 👋