🧰 The Toolstack for Mobile Apps Builders

Overlooked #61

Hi, it’s Alexandre from Idinvest. Overlooked is a weekly newsletter about underrated trends in the European tech industry. Today, I’m sharing a mapping of the most common tools used by mobile apps to set up, run and grow their business.

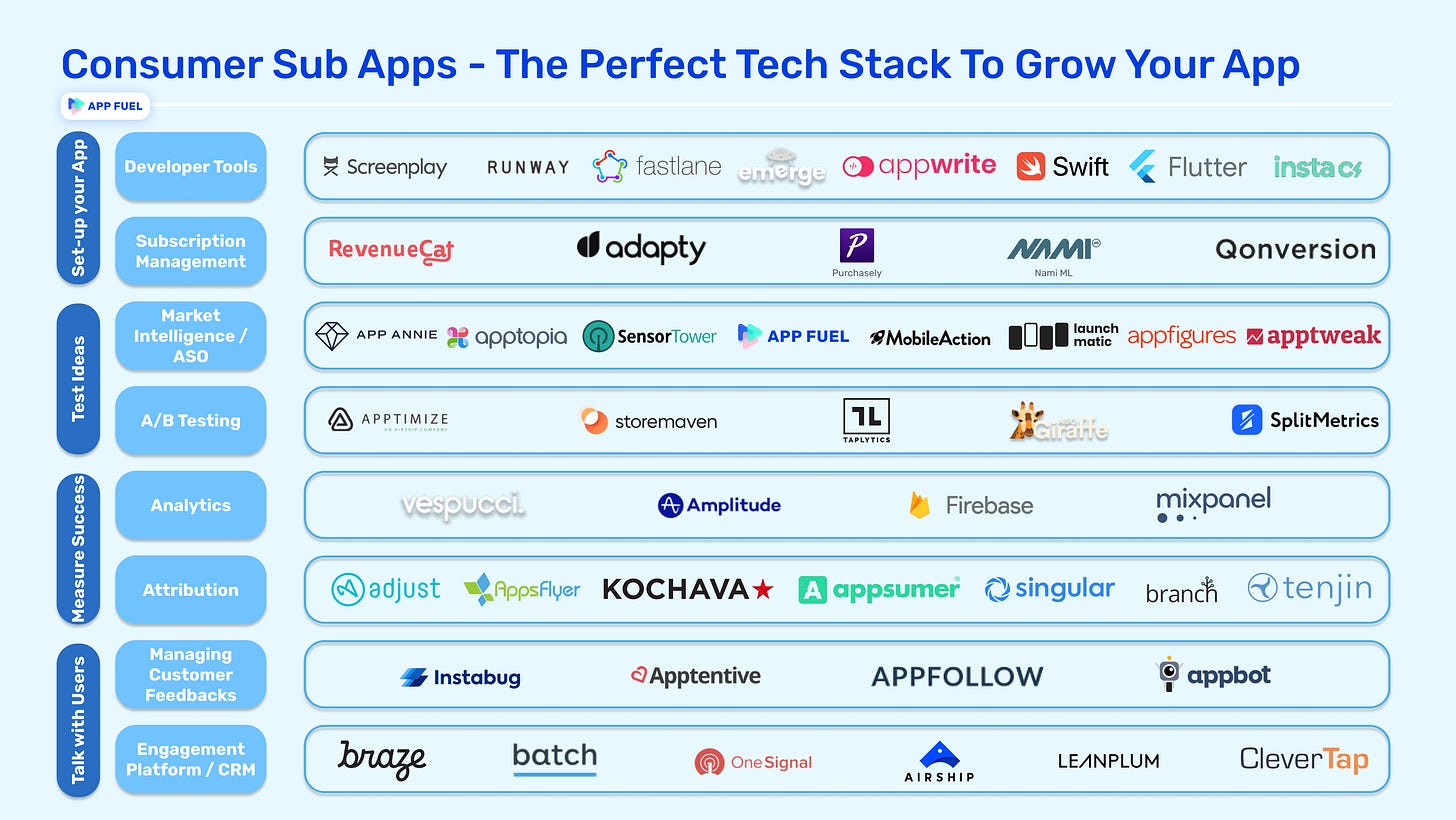

With Clément, we created the toolstack used by mobile apps builders to set up, run and grow their applications. We talked with mobile app founders and crawled the internet to identify 60+ providers and 6 trends.

You need to have the right toolstack as a mobile developer because there is a strong competition on mobile app stores and the prize pool has never been as high as it is today.

People are now spending more time on mobile than watching TV. In H2 2020, Americans watched 3.7h of TV per day whereas they spent 4h on their mobile. Mobile has become the most used device. (AppAnnie)

In 2020, consumers spent $111bn on mobile app stores including $31.5bn in non gaming apps (28.4% of total). (SensorTower)

Mobile app stores are noisy and the noise keeps increasing. There are 2.9m apps on the Google Play Store (Jun. 2020) and 4.4m apps on the Apple AppStore (Jul. 2020). Every month, 30k new apps are released on the AppStore and 100k on the GooglePlay Store. (Mindsea)

At the same time, people are downloading fewer apps than ever before and 2/3 of users have less than 30 apps on their phone. (Mindsea)

Mapping The Toolstack for Mobile Apps

Initially, we wanted to create a mapping of all the tools that were only used by developers on subscription-based mobile apps. Along the way, we discovered that only subscription management platforms such as RevenueCat or Purchasely were solely used by these apps, all the other tools we investigated were used by all the other mobile apps builders (e.g. analytics, attribution, market intelligence etc).

We divided our mapping into four main sections:

Set up your app: we included tools to develop your app and to set up subscription payments to monetize your app.

Test ideas: to generate ideas, app builders will use tools to gather qualitative and quantitative data on their competitors, on best practices and on other app verticals. Once they have a backlog of ideas, they will A/B test them to know whether they work and iterate them if needed.

Measure success: we included analytics tools to measure most common app metrics as well as special events that are more relevant to your app. We also include attribution tools which are key to measure the performance of your paying marketing efforts.

Talk with users: app builders use tools to collect feedbacks within and outside their app (social media, app stores reviews). They will also engage with their customers through engagement platforms used to design and manage notifications.

Note that we focused mostly on mobile apps. We neither included marketing campaign tools (e.g. AppLovin, social media ad networks, Apple and Unity ad networks etc.) or tools that were not mobile first (e.g. Intercom and Zendesk which are both used for customer support or Optimizely used for A/B testing). You can access a more exhaustive list in the below Airtable's link. If you want to be added in this mapping, you can send me an email at ade@idinvest.com.

We have also identified 6 trends worth sharing about the tools used by mobile apps.

Trend n°1 - Defining and Owning a Category

The best companies in our mapping have been able to design and capture their category (AppAnnie for market intelligence, Adjust/AppsFlyers for attribution, Amplitude for analytics, RevenueCat for subscription management).

It's a general learning in entrepreneurship which is perfectly highlighted in Play Bigger. Your product and your company don't evolve in a vacuum. If you don't build the framework of the category, someone else will build it for you at your expense. Category building is a way to position yourself instead of being positioned. You should not try to sell a better alternative than existing solutions but you should try to sell a differentiated value proposition. Customers don't come for a better solution but they come to discover a new point of view on the world and to adhere to the emergence of a new category. If you succeed in designing and owning your own category, you will capture the largest market share and profit share.

Trend n°2 - The Love Hate Relationships with Mobile App Stores

Apple and Google are obviously eminent stakeholders in this ecosystem as they own the two main mobile app stores, they fix the rules and have developed their own tools. For instance, Apple uses Swift as a programming language, TestFlight to test applications in closed beta, Analytics for basic analytics, Apple Search ads to drive app discovery etc. Apple and Google are both stakeholders and regulator of the mobile app ecosystem.

It means that all the third party tools are always at risk to become irrelevant if Apple or Google changes some rules on their stores.

In France, AppGratis learnt it the hard way. It was an app discovery tool founded in 2008. It reached 12m users on iOS before being removed from the AppStore in 2013 for a violation of the App Store's rules.

With iOS 14.5's upcoming changes to give additional privacy to Apple's users, the business of attribution players is at risk. iO14.5 is killing the usability of the IDFA (The Identifier for Advertisers). It’s a device identifier assigned by Apple to a user’s device. It’s used by advertisers to track ad performance and customize advertising. With the Apple’s update, you will have to get an opt-in from users to allow IDFA tracking and opt-in rates could be as low as 10-20%.

At the same time, every major rule’s change creates an opportunity for new players to jump in and build a better suited solution. I won’t be surprised to see a new wave of tools that help mobile apps to manage advertising in a post-IDFA world based on other marketing principles like incrementality (e.g. Incrmntal) or on stronger modelling capabilities.

Trend n°3 - At What Size Should You Stop Using Third Party Tools?

While discussing with mobile app developers, we discovered that after a certain threshold in revenues or users, large app developers internalise some segments of their tool-stack to have custom made solutions and a greater flexibility to test new ideas on their product.

Moreover, some tool makers have even expanded their activity into publishing by using their internal tech stack as a differentiator to become a successful app publisher. AppLovin is probably the best example. The company started as a mobile app marketing platform and has launched a successful gaming publishing platform called Lion Studio.

Trend n°4 - The Rise of Developer Tools to Fasten the Time Span to Release a New App

It's no longer uncommon to hear about entrepreneurs who launched the 1st iteration of their mobile app in less than 2 weeks. Modern mobile app developers focus only on product design and development. Anything else can be externalised to third party services. You will use Firebase as a cloud service, Revenue Cat to set up in app-payments, Amplitude for analytics and Fastlane to publish your app on mobile stores. Moreover, most of these tools have a freemium model enabling you to be live with your app for almost no cost.

Trend n°5 - Mobile First Tools vs. Multi-Platform Tools with a Mobile Version

When you dig into different mobile app stacks, we discovered that mobile app developers use both mobile-first tools (e.g. RevenueCat for in app purchases, AppAnnie for market insights) as well as multi-platform tools (e.g. Optimizely for A/B testing, Intercom for customer feedbacks). It's not always straightforward to go from mobile to other platforms and vice versa. It means that there is an opportunity for new tools in categories that are not dominated by mobile first players.

Trend n°6 - The Mobile App Toolstack Ecosystem is also Driven by Internet’s Trends

The mobile app toolstack ecosystem is also evolving with new technological trends. I will just give you two examples:

Vespucci is reinventing the mobile analytics category thanks to machine learning. Most existing analytics solutions are based on the assumption that you know what you are looking for when Vespucci helps app builders identifying the hidden behaviours and the behaviours they should track thanks to ML models.

Flutter Flow is a no-code mobile app builder specifically designed for the Google environment (Flutter + Firebase). It’s a great tool because it removes the barriers to start building a new app. As a non developer, I can build and release my first prototype. I can also make my first iterations. And when I want to take my app to the next level, I don’t have to restart from scratch and I can export usable Flutter code.

Thanks to Clément, Matthieu, Sacha, Thomas, Thibault, Maxime and Julia (🦒) for the feedback! Thanks for reading! See you next week for another issue! 👋

Thanks a mil for mentioning AppFollow, Alexandre. However, we also develop ASO and Subscription analysis tools. The first one gives you both an overview of your organic traffic/campaigns performance and a deep dive into which keywords bring you installs. The second one shows all the data on subscriptions including conversion to paid, churned users, and more.