🗺 Y Combinator - Winter 2022 Batch

Overlooked #108

Hi, it’s Alexandre from Eurazeo (ex. Idinvest). I’m investing in seed & series A consumer and consumer enablers startups all over Europe. Overlooked is a weekly newsletter about venture capital and underrated consumer trends. Today, I’m digging into YC’s most recent batch to spot recurring tech trends from the 400+ participants.

As usual, I reviewed the startups in the latest YC batch (see editions for the previous batches here: YC-W20, YC-S20, YC-S21). As a reminder, YC is the largest accelerator worldwide. It’s a 12-week remote program that happens twice a year and YC invests $500k in every company it accelerates.

I cowrote this edition with Elise who is working with me at Eurazeo!

We brainstormed together and came up with the following trends in this batch: (i) climate, (ii) no-code, (iii) orchestration, (iv) product as API, (v) “X for Y startups”, (vi) making SaaS companies more efficient, (vii) vertical solutions for local businesses and (viii) consumer verticalised marketplace.

Metrics

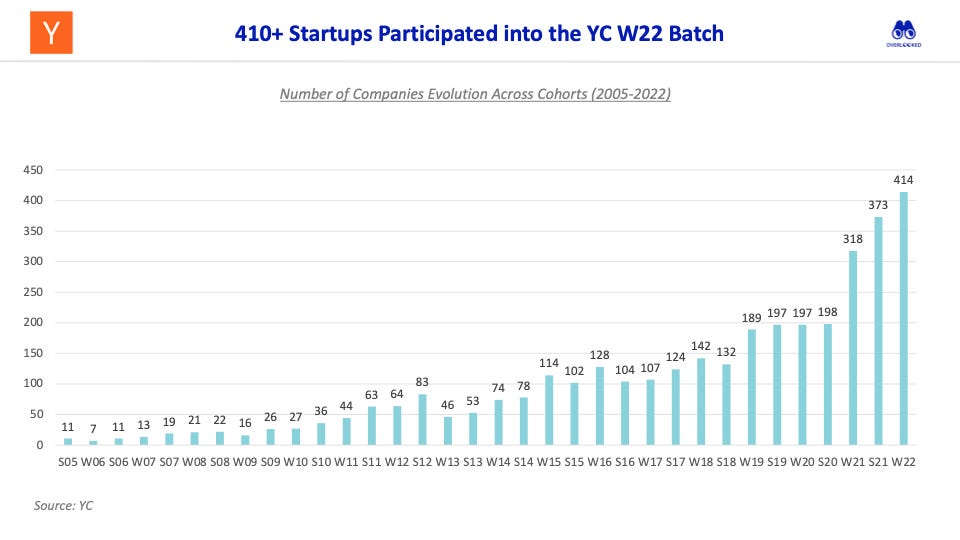

YC broke a new record with 410+ startups participating in this latest batch (10% increase vs. previous batch, 100%+ increase vs. YCS20 batch).

For the 3rd consecutive batch, US startups aren’t the majority. 50% of startups are from other countries than the US and 10% are from Europe.

YC remains dominated by 4 main verticals capturing almost 90% of the startups: B2B software, consumer, fintech and healthcare.

19% of YC-backed startups in this batch have at least one female cofounder which is significantly more compared to what we see in most VC funds’ portfolio.

Climate

If there’s one thing to remember from this YC batch, it’s the clear breakout of Climate tech, with almost 30 new companies in the space (vs. 15 in the summer 2021 batch).

A notable difference in this winter 2022 batch is that the space is moving from pure software plays (carbon accounting, carbon offsetting etc) to real-life hardware innovations:

We’re particularly interested in players developing new materials to reduce carbon emissions:

Carbon crusher re-uses old road materials to crush roads in need of maintenance, replacing oil with carbon binding lignin

Phase Biolabs builds a fermentation technology to convert CO2 emission into carbon-negative solvents used in the pharma, sosmetic and paint industries

Alga Biosciences modifies kelp to create a feed additive for cattle that stops them from producing methane.

Technologies are also emerging to remove or capture carbon, in the air (Airmyne) or in the sea (Seabound).

In the energy sector, there are two companies aggregating data and making them accessible to third parties via API (Plaid-like value proposition): (i) Telematica with Electric Vehicles (EVs) data and (ii) Pelm with energy data from utilities. I love the use cases that can be unlocked via these APIs:

For Telematica: (i) a service provider to an EV owner (e.g. a charging station) can access the data on the car in one-click (e.g. battery level), (ii) provide smart route planning tailor made for EVs, (iii) offer customised and usage based financing or insurance.

For Pelm: (i) provide simulation of energy savings to convince potential customers to buy solar panels, (ii) get insights on energy consumption of your customer base, (iii) help users understand their energy habits.

In the e-commerce sector, two startups promote second-hand consumption. Re-Mint builds a resale as a service service specifically designed for D2C brands and Fleek develops a B2B wholesale marketplace for second-hand fashion.

No-Code

This new batch underlies the growing importance of no-code as an enduring trend with a strong push towards empowering non technical users to create and build products without needing coding skills.

A major wave of solutions focuses on unlocking the use of data for business units, thus by-passing the need for important data engineering teams. They make data extraction self-serve and actionnable on pre-built dashboards and models. That’s the case of:

Helloguru and Bracket which automatically sync data sources into existing business systems such as Salesforce, Hubspot, or Intercom,

Livedocs, which can help operators build off-the-shelf reports with live data automatically populated from apps and other sources (Stripe, Google Analytics, Segment, etc.),

Supersheets, a start-up enabling operational teams to build their own customized data tools on top of databases,

or Cerebrium, which connects businesses’ SaaS tools with pre-built metrics, dashboards and MeL models that can be used by all operators (from CTO to marketing manager to head of growth).

Orchestration

The rise of Saas and the multiplication of tools in companies’ tech stacks have led to an increase in complexity. Complexity at the micro-level to identify and access the right data easily. Complexity at the macro-level to visualize the tech architecture as a whole and monitor its health and potential vulnerabilities. Put simply, managing the tech stack has become a logistical nightmare. Enter a series of YC companies aimed at orchestrating workflows in different verticals:

i) First, the orchestration of data coming from different sources. As mentioned in the no-code section, these solutions focus on by-passing silos and automatically syncing data collected from apps or from the data warehouse into the different business apps. Among the current YC-batch, we can identify the following companies: Helloguru, Bracket, Livedocs, Supersheets, Cerebrium,

ii) At the process level, Takt focuses on analysing the performance of a process end-to-end when it runs across multiple softwares (starting in Hubspot and ending in Asana for instance),

iii) A the infrastructure level, Brainboard integrates all tools and allows engineers to visualize the whole cloud architecture,

iv) Finally, iomete goes beyond the orchestration of best-of-breed tools and makes the bet that start-ups/scale-ups will value simplicity over performance of each of the product’s parts by offering an all-in-one platform approach, replacing Snowflake (Lakehouse), Databricks (Jobs and ETL), Fivetran (Onboarding 3rd party data), Informatica (Data Governance), and Looker/Tableau (BI) with a single solution.

Product as API

We love companies abstracting a complex workflow to make it accessible to third parties both via API and a white label platform (e.g. Stripe for payment, Twilio for communication or Auth0 for authentification).

In this batch, there are 4 companies replicating this playbook:

Snippyly: add a collaboration layer (Figma-like) to your product,

Verdn: add a sustainability pledge during your checkout process,

Shaped: add a personalisation layer to your product for your feeds, notifications and recommendations,

Unlayer: add an emailing builder to your product.

Making SaaS Companies More Efficient

There are several companies building tools to make SaaS more efficient in the way they operate, addressing specific functions like user research, user feedback, onboarding or customer support.

Rally (US) is a CRM for user research. It helps UX research, product and design team to have a unique and digital source of truth to coordinate user research. It removes friction at all stages of a user research: recruiting, setting-up meetings, drawing conclusions, rewarding participants, etc.

Onboard (US) is a solution for SaaS to automate and streamline the onboarding of their new customers.

1Flow (US) is a solution to collect user feedbacks to improve your product, to boost engagement, to prioritize your future product roadmap and to reduce churn.

Atlas (US) is a modern customer support platform with contextual data on your customers as well as support tools (chat, ticketing, automated communication) for your customer support team.

"X for Y startups"

"X for Y startups" are startups in which "X" is a successful startup that serves as an inspiration and "Y" is an application to this inspiration that could be a geography, a product, a business concept or a customer segment. Sometimes, several applications are mixed (e.g. Stripe's Radar for Africa). In this batch, companies which are serving as inspiration are Faire, GoPuff, Opendoor, Flexport, Meesho, Clearco, Klarna and Plaid. Below are some interesting examples:

CrediBook: Faire for Indonesian SMBs. It helps micro, small and medium businesses to digitize their operations. It started as a free digital bookeeping app. It has expanded to digitalizing procurement with features like ordering, BNPL payment and logistics support.

Save.in: Klarna for healthcare in India. Save has a network of offline healthcare providers for which it offers instalment payments (e.g. dental, optical, hearing, veterinary, etc.). It reduces the friction to access healthcare products and services.

Tendo: Meesho for Africa. It enables anyone to become a merchant without having upfront inventory. A merchant will source products on Tendo and will have dedicated tools to sell them on Whatsapp.

Vertical Solutions for Local Businesses

In this batch, there are several B2B procurement marketplaces for local businesses in emerging countries:

Alima (in Mexico): focused on restaurants to source fruits & vegetables.

Pantore (in Brasil): focused on restaurants and inspired by community group buying players in China as restaurants can bundle their orders to get discounts from their suppliers.

Amiloz (in Mexico): focused on corner stores to source branded products (drinks, food, household products). Amiloz plans to monetize via inventory financing.

In the US, Cinapse is building an all-in-one platform for TV and movie production teams. Cinapse manages workforce scheduling, replaces paperwork with a mobile app and synchronises communication in a single place.

In Latin America, there are two solutions targeting the construction sector. First, Hippo (Colombia) is removing silos between stakeholders in the construction industry (construction firms, contractors) by connecting the different solutions they use. It's a Segment or a Plaid for construction data. Second, Vobi is building a project management SaaS dedicated to construction SMBs with two core modules: procurement and quotes.

Consumer Verticalised Marketplaces

I told you in a previous issue that I'm a big believer in ultra-verticalised consumer marketplaces because some verticals' size are still underestimated and because ultra-verticalisation unlocks additional revenue streams (e.g. a membership, a D2C brand, etc.).

Wantd is targeting the sneaker and streetwear vertical going after large incumbents like Goat and StockX. It starts with a data play where it aggregates and displays historical and current pricing data from the major platforms. It has also specific tools for sellers (e.g. inventory management, cross-platform listing, etc.).

Boardcave is targeting the surf category with a verticalised marketplace to buy gear (surfboards, fins, wetsuits, wax, towels) but also a media to learn more about surf and get the latest surfing news.

Pursuit is a marketplace for outdoor activities (hunting, fishing, skiing, kayaking, backpacking). It builds a differentiated supply with activities done with guides on private properties.

Thanks to Elise and Julia (🦒) for the feedback! Thanks for reading! See you next week for another issue! 👋