Hi, it’s Alexandre from Idinvest. Overlooked is a weekly newsletter about underrated trends in the European tech industry. Today, I’m sharing the most insightful news of September.

For 2020, I want to pick one piece of news per day and write a short comment about it. I want to talk about something that strikes me. Something that happened in the tech ecosystem. Here is the issue for September!

Please note that the date picked for each event is not always the exact date of the event but the date I decided to write about the event.

Tuesday, Sep. 1st: Patreon raised a $90m round at a $1.2bn valuation (vs. $660m valuation at the previous round) led by Welligton and New Enterprise Associates. Patreon allows creators to get paid by their fans. 200k creators and 6m fans use its platform. I believe that the pandemic was a turning point for many creators who lost crucial revenue streams (advertising deals for influencers, concert revenues for musicians etc.). Having a direct relationship with and being paid by your audience on Patreon is probably one of the most sustainable ways to thrive. (The Wall Street Journal)

Wednesday, Sep. 2nd: Yann Ranchere is digging into the prosumer video production market. Top content creators on Youtube and Twitch have built unbelievable set ups to be able to offer high quality content to their audience. Companies will have to follow suit to share videos with their stakeholders. As a result, there is an opportunity to create tools that will allow anyone to create high quality content on his own. (Yann Ranchere)

Thursday, Sep. 3rd: The French government will dedicate €7bn out of the €100bn economic stimulus package passed to face the covid crisis on digital investments. (Techcrunch) Below are the main investments:

€2.5bn for BPI to invest in startups directly through equity and indirectly as a limited partner in venture funds,

€1.7bn to modernize public IT,

€1.0bn in State aids dedicated to innovation (scientific research, R&D spendings),

€385m to help SMBs in their digital transformation,

€300m to support education for the tech sector (i.e. training engineers, data scientists and other key roles to make startups successful),

€250m on digital inclusion to simplify admin procedures and make sure older people are supported,

€240m to deploy fiber networks across the country,

€200m to help car manufacturers and the aviation industry in their digital transformation.

Friday, Sep. 4th: A/B testing leader Optimizely got acquired by Episerver which offers tools to manage marketing digital content at a valuation below $600m. (Techcrunch, Episerver)

Optimizely (founded in 2009 in the US) had outstanding backers with Benchmark, a16z, Index and Goldman Sachs on the cap. table. Itraised $200m and had to lay off 65 employees (15% of the workforce) earlier this year because of the covid crisis.

Episerver (founded in 2014 in Sweden) raised with Accel and KKR before being sold to Insight in 2018 at a $1.1bn valuation.

Saturday, Sep. 5th: Seedrs is opening up its secondary market platform to all companies. The secondary market was already available to companies which had raised a crowdequity round on Seedrs with a £500k monthly transaction volume. Seedrs is partnering with a cap. table management software called Capdesk which allows all companies on Capdesk to sell their shares on Seedrs’ secondary market. The tech secondary market is increasingly opening its doors to non professional investors. Equity crowdfunding platforms and cap. table management software are best positioned to seize this opportunity. (Techcrunch)

Sunday, Sep. 6th: I watched a webinar organized by Angular Ventures with Airtable’s early employee David Peterson on bottom-up growth in the B2B world. David gave good insights on bottom-up growth applied to an horizontal product like Airtable. He explained that an horizontal product should start with a self served distribution to let your users find the relevant use cases for your product. At this stage, you should be a “user anthropologist” that talks to as many users as possible and helps them succeed with the product. Once you have found the most compelling use cases, build a dedicated go to market strategy for people wanting to use them.

Monday, Sep. 7th: I read a paper on Ben Thompson’s newsletter called Stratechery. Ben started to monetize its content back in 2014 by putting its articles behind a paywall. He sends 4 posts per week (including 3 paying posts) and has recently started a paying podcast called Dithering.fm. Ben does not communicate on the number of paying subscribers but estimates range between 20k and 30k implying annual recurring revenues between $1.6m and $3.6m. (Andreas Stegmann)

Tuesday, Sep. 8th: Spacefill raised €7m series A led by Idinvest (💙). It's a B2B marketplace to rent storage space from third party warehouses - already works with 350 customers and 3k warehouses in France. Now, the goal is to expand in other European countries and to iterate the product to digitize this old fashioned logistic industry. (Usine Digitale)

Wednesday, Sep. 9th: Dawn Capital raised a $400m fund IV to invest in series A and series B in B2B European startups in the following themes: data, analytics, security, fintech and future of work. Dawn portfolio includes great companies like iZettle (sold to PayPal in 2018), Dataiku, Collibra and Tink. It also noteworthy that Dawn has managed to build an investment team respecting the gender equality. (Sifted)

Thursday, Sep. 10th: Digital Currency Group acquired Luno for an undisclosed amount. Luno is a London-based crypto exchange. It has a strong presence in developing countries (esp. in Africa and Asia). Luno has 5m users, was created in 2013 and raised $14m in funding from Balderton and its acquirer. (BusinessWire)

Friday, Sep. 11th: Roam Research raised a $9m round at a $200m valuation with Lux Capital, True Ventures and Stripe co-founders. I'm in love with this product and I'm more bullish on Roam than on any other productivity tool I came across in the past few years (inc. Notion and Evernote). I started to use Roam 4 months ago and my second brain has grown exponentially since then. Each point in the below graph is a page in my Roam database and each line is a link between 2 pages. The biggest points are the most linked pages (my dealflow, my NL, my topics etc.). I'm using Roam all day long to write down notes on my meetings, my ideas, my newsletter issues, the podcasts I listen to, the articles and books I read, the videos I watch, the company and people I admire etc. As a knowledge worker, it has been a game changer in my life. I can't wait to open-source proper segments of my database and to merge it with others to build the next-gen Wikipedia. If you want to know more, I wrote a paper on Roam back in May. (The Information)

Saturday, Sep. 12th: Curio raised a $9m series A led by Earlybird with the participation of Draper Esprit, Cherry and Horizons Ventures. It's a subscription based mobile app to access high quality journalism content translated into audio by professional actors. Now, the goal is to keep adding content, to refine the app and grow the user base in the US, the UK and other English speaking countries like Australia and South Africa. (Techcrunch)

Sunday, Sep. 13th: Airtable raised a $185m series D led by Thrive Capital at a $2.6bn post money valuation. Airtable started as a super easy to use spreadsheet combined with a powerful database. The goal is now to build a platform on top of this database/spreadsheet to let users craft applications suited to their needs with no-code or low-code solutions. With the announcement of the round, Airtable introduced an updated version of their blocks now called apps. Before, users only had access to a reduced number of no-code based applications. Now, users can build their own apps in Javascript and sell them if they want on a marketplace. Moreover, Airtable also announced “integrated automations” to automate repetitive workflows in the Airtable's ecosystem. (Techcrunch)

Monday, Sep. 14th: eFounders startup Swan raised a $5.9m seed round led by Creandum with the participation of Bpifrance. Swan is building a banking as a service platform. It allows companies to start issuing cards, creating bank accounts and issuing IBANs through API calls. The company is targeting non financial companies that can become fintech-enabled businesses by adding financial services to their offering. (Techcrunch, Creandum)

Tuesday, Sep. 15th: Klarna raised a $650m funding round at a $10.65bn post money valuation led by Silver Lake compared with its previous $5.5bn valuation set back in Aug. 2019. It's a buy now pay later solution allowing shoppers to smooth their expenses over several months. It's basically an interest free loan for the customers. Merchants are paying Klarna a percentage of the transaction as an incentive to acquire more users. The company is now focusing on penetrating the US market in which it has already 9m customers. (Sifted, Techcrunch)

Wednesday, Sep. 16th: Zwift raised a $450m growth round led by KKR alongside Amazon Alexa Fund, Specialized Bicycles and Zone 5 at a valuation around $1bn. To use Zwift, you have to buy a hardware (a smart trainer produced by third parties) that you will connect to the bike you use and you will access a fitness app on your TV or on your computer to simulate bike training in your house. For instance, 117k users completed a virtual version of the Tour de France organized back in July 2019. Zwift is selling a $15 monthly subscription and has also a product for runners. (Zwift)

Thursday, Sep. 17th: Dutch e-bike manufacturer VanMoof raised a $40m series B from Norwest, Felix Capital and Balderton. The covid crisis is reshuffling our cities with a growing importance given to cyclists to unclog subway infrastructures. As a consequence, the ebike market is growing at a strong pace. VanMoof sold more bike in the first 4 months of 2020 than in the two years prior combined and has grown by 220% during the lockdown. The funding will be used to sustain demand and reduce delays to deliver bikes, to build a range of services and software around the bike (mobile app, customer support, remote diagnosis etc.) and to go international (US and Germany). With the ongoing Tour de France, I guess that it's a decent timing to announce bike-related fundings. (Balderton, Techcrunch)

Friday, Sep. 18th: I watched Apple's event during which they released their new watches and iPads. Apple continues to execute towards a vision where services, healthcare, sustainability and privacy are at the core of everything they do. (Apple)

On healthcare, the watch was presented as Apple's cornerstone with this powerful tagline "the future of your health is on your wrist." Apple has also introduced Apple Fitness+ which is a $79.99 annual subscription to access fitness classes in different sports (yoga, cycling, trade mill, running etc.) augmented by the metrics tracked by the Apple watch.

On services, Apple announced its long awaited service bundles with three offers bundling key Apple services at a reduced cost (iCloud, Apple Music, Apple TV+, Apple Arcade, Apple News, Apple Fitness+).

On privacy, Apple users can now access iOS14 without the promised changes on mobile advertising re-targeting. Apple decided to delay the implementation following push-backs from advertisers.

Saturday, Sep. 19th: Accel organized an event on open source with star companies in the field and released their Open 100 which is a list of the fast growing open source companies. (Accel)

Sunday, Sep. 20th: I love this graph on the hardware evolution of the main scooter players. Bird and Lime have decided to internalize the hardware manufacturing. European players are working with the two players which are OKAI and Segway that are selling them scooters with swappable batteries. (Augustin Friedel)

Monday, Sep. 21st: London-based seed fund Kindred Capital raised £81m for its second fund. Kindred has an original model in the venture world because all their founders become co-owner of the fund by having shares with carried interest. Founders are not only incentivized to be successful in their journey but also to be active in the community and source other potential investments for Kindred. With its first fund, Kindred invested in companies like Pollen (marketplace in the travel space) FiveAI (AI for autonomous vehicles), Portify (credit scoring for independent workers) or LabGenius (next-generation protein therapeutics). (Techcrunch)

Tuesday, Sep. 22nd: Mirakl raised a $300m funding round at a $1.5bn valuation (🦄) led by Permira with the participation of existing investors like 83North, Bain, Elaia and Felix. Mirakl is a software that helps e-commerce merchants to launch and operate a marketplace. The company has 300 customers both in B2C (Best Buy, Carrefour, Darty, Office Depot) and in B2B. Mirakl also launched a meta-marketplace to let third parties partners offer their products to Mirakl's customers. (Techcrunch, Elaia)

Wednesday, Sep. 23rd: Daphni announced the first closing of its second fund called Yellow. The Paris-based fund raised €90m and is planning to raise a total amount between €150m and €200m. LPs include BPI, Swen Capital, ProBTP, Arké, Macif, Accor, SEB and Bouygues. The team that will deploy the fund is a mix of the original Daphni team (Pierre-Eric Leibovici, Pierre-Yves Meerschman) and the Jaina Capital team (Marc Simoncini and Charles-Henry Tranié). Daphni is still investing in "tech for good" businesses. It will invest in 30 early stage B2C and B2B2C startups with initial tickets between €1m and €5m. (Daphni, Maddyness, Sifted)

Thursday, Sep. 24th: Daniel Ek (Spotify’s founder and CEO) pledged to invest €1bn in European deep tech startups (ML, biotech, energy, etc.). He wants to fund the next wave of European giants by giving them sufficient funding to keep executing their vision and not selling too early. (Sifted, Techcrunch)

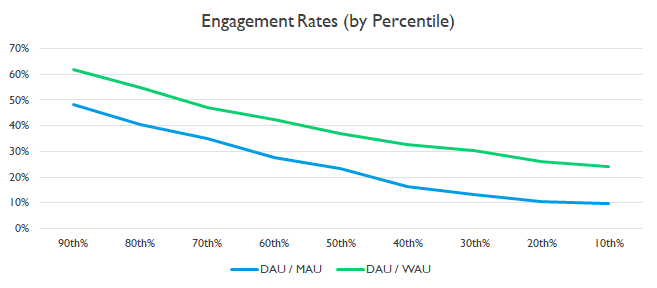

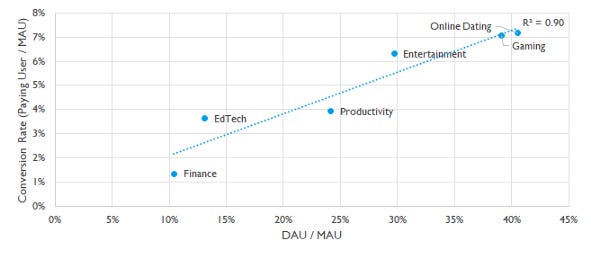

Friday, Sep. 25th: I found a good benchmark on consumer subscription metrics. Below are the main learnings. (Parsa Saljoughian)

Top decile consumer subscription businesses have a 65% M12 retention, top quartile 50%.

Prices and retention rates are correlated: the more you charge, the harder it is to retain your customer.

DAU/MAU around 50% is top decile and over 35% is top quartile.

Conversion rates are highly correlated with engagement rates (Spotify 45% conversion rate on MAU were excluded from these data)

Saturday, Sep. 26th: I listened to an episode from my new favorite podcast called Below the Line with Alfred Lin who is partner at Sequoia. Alfred is a legend. He cofounded both LinkExchange (sold to Microsoft) and Zappos (sold to Amazon) before joining Sequoia in 2010 and investing in outstanding companies like Airbnb and Doordash. It's just unbelievable to have such a track record both as builder and investor. (Below the Line)

Sunday, Sep. 27th: Index released a guide for founders planning to go to the US with valuable and actionable insights. The guide is based on interviews from 350 European and Israeli VC-backed startups that crossed the Atlantic in their journey. Index has built a framework with 4 main archetypes and concrete advice for each archetype (e.g. on the timing of the expansion, on the team set up there, on the good funding partners to do it, on how to grow operations etc.) (Index)

Monday, Sep. 28th: Bitpanda raised a $52m series A led by US-based and fintech focused Valar Ventures. The company started in the crypto world with an exchange for both consumers and professional traders. The company has recently added precious metals to their exchange using their crypto knowledge to tokenize any asset. I love the idea of using innovation from the crypto world to apply it to traditional finance. With this round the goal is to expand in more traditional asset classes (inc. stocks and ETF) and in other geographies beyond Germany. (Techcrunch, Bitpanda)

Tuesday, Sep. 29th: Totem raised a €4m seed round led by Finland-based fund Maki to bring a convenience store in any workplace. It started with free food paid by employers and is now expanding to let employees pay for food (e.g. lunches & snacks) and beyond without leaving their office. (Sifted)

Wednesday, Sep. 30th: Colette raised a pre-seed round with business angels. The company is trying to make intergenerational cohabitation sexy and viable at scale. There are three ingredients I love about the company besides its outstanding team: (i) Colette unlocks a renting supply that was inexistant in the market, (ii) it's a community based business with a club membership and numerous events organized between seniors and young people and (iii) it has the potential to become a fintech-enabled business dedicated to senior people. (Matthieu Vaxelaire)

Thanks to Julia for the feedback! 🦒 Thanks for reading! See you next week for another issue! 👋